About ICA

‘Find a fairer way’ to fund NSW emergency services

by insuranceca

‘Find a fairer way’ to fund NSW emergency services

News release

Monday, 13 February 2023

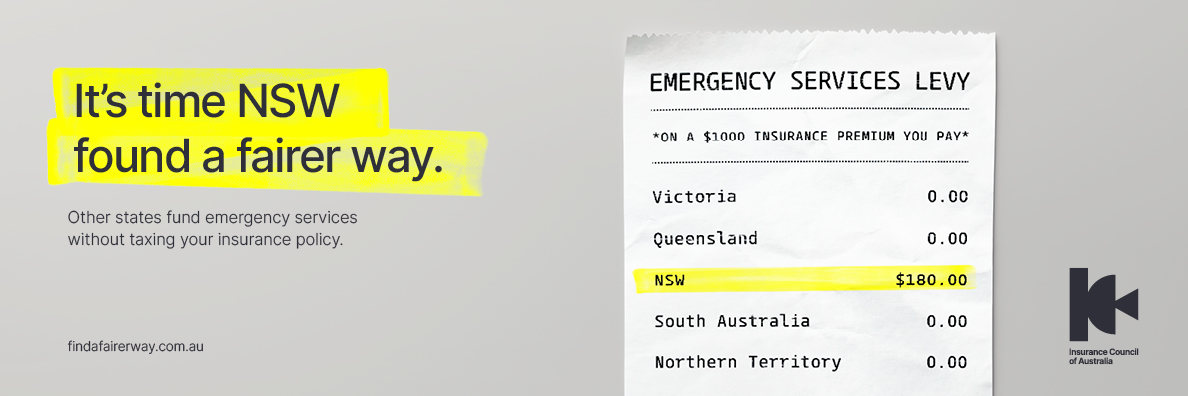

Home insurance customers in NSW will see a reduction of around 15 per cent in their annual premium costs if the next State Government removes the Emergency Services Levy (ESL) and finds a fairer way to fund emergency services, a new report from the Insurance Council of Australia (ICA) finds today.

Released in the lead up to next month’s state election, A Stronger NSW finds that because of the ESL NSW insurance customers are paying nearly three times the amount of state taxes than Victorian insurance customers.

This is contributing to an estimated 13 per cent of NSW households being uninsured – double the rate in Victoria.

NSW is the only mainland state that still funds emergency services by applying a levy on insurance, which is currently adding around 18 per cent to home insurance premiums and up to 40 per cent to business cover.

To support its call for reform of the ESL, a state-wide advertising campaign commences today calling on the next NSW Government to “find a fairer way” to fund emergency services and bring NSW in line with every other mainland state and territory.

This campaign is backed by new research conducted for the Insurance Council which shows that almost two-thirds of NSW voters (65%) support removing the ESL and replacing it with an alternative funding model for emergency services.

In addition to reform of the ESL, A Stronger NSW outlines eight other policy recommendations for the next NSW Government to reduce risk and put downward pressure on the cost of insurance in the State:

- Prevent the development of new homes in high-risk areas by reviewing land use planning arrangements based on water catchments

- Protect homes and communities by investing in measures such as community infrastructure, improved flood early warning systems and home retrofit programs

- Design and construct stronger homes by including the principle of resilience in building standards

- Reform written-off vehicle rules for sustainable car insurance and to promote supply of second-hand vehicles

- Accelerate the transition to electric vehicles by ensuring homes are EV ready and addressing skills shortage in EV repair

- Review current tort law and civil liability settings to increase insurance affordability and availability for small businesses

- Remove unfair insurance requirements from government contracts

- Enable households, communities, government, and agencies to better prepare, protect and respond to disasters through improved and consistent data standards

In 2022 NSW suffered $3.3 billion in insured losses from 150,100 claims relating to extreme weather events, the majority of which came as a result of the February-March floods which cost almost $2.9 billion in insured damages across the State.

Quote attributable to ICA CEO Andrew Hall:

The policy recommendations outlined by the Insurance Council today in our A Stronger NSW report will drive action on reducing risk and addressing the critical issue of insurance affordability and availability in NSW.

The abolition of the emergency services levy is key to this: the next NSW Government must find a fairer way to fund emergency services without having the burden fall directly on insurance policy holders.

At a time when adequate insurance cover is more important than ever, home insurance customers in NSW are paying the most tax in Australia and this is leading to lower levels of insurance when compared to other states.

The NSW emergency services levy weakens our collective capacity to recover from natural disasters and increases the burden on NSW taxpayers for financial relief.

We encourage whoever wins the NSW election in 40 days’ time to urgently take up this and the other eight policy proposals to reduce risk and improve insurance outcomes in the State.

For further information go to: www.findafairerway.com.au

New appointments to the Insurance Council Board

by insuranceca

New appointments to the Insurance Council Board

News release

Wednesday, 2 November

The Insurance Council of Australia (ICA) welcomes Hugo Schreuder, Chief Executive Officer, Youi Pty Ltd, and Paul Sofronoff, Chief Insurance Officer, RACTI to the ICA Board. Both Board appointments will commence on 5 December 2022.

Comment attributable to Andrew Hall, CEO Insurance Council of Australia:

The appointments of Hugo and Paul to the ICA Board come at a time of great forward momentum for the general insurance industry, particularly our role in spearheading the creation of a more resilient Australia by guiding government policy and investment.

Both new Board members bring diverse experiences and perspectives and will add to the depth and breadth of knowledge and experience of the Board.

On behalf of the Board, I look forward to their valuable insights and contributions over the duration of their tenure.

Paul Sofronoff – Chief Insurance Officer, RACTI

Paul moved to General Insurance with AAMI following a legal career working with government and regulatory bodies. At AAMI he moved across the organisation from General Counsel, to insurance operations including distribution, pricing, marketing and claims management.

Following Suncorp’s takeover of AAMI’s parent company Promina his roles included risk and policy administration, recoveries and settlements. He was also responsible for Suncorp’s Investigation team, established to increase the management of fraud.

After 20 years with AAMI/Suncorp, Paul recently moved to RACTI as Chief Insurance Officer.

Hugo Schreuder - Chief Executive Officer, Youi

Hugo Schreuder began his insurance career in South Africa in 2003 at OUTsurance and is the founding Chief Executive Officer of Youi Insurance, which has now been operating for 14 years..

Hugo has taken Youi from a start-up to its current position of earning over $1 billion in gross written premium. He was instrumental in the diversification of Youi’s products and introduced Blue Zebra Insurance as a new broker distribution partner.

Hugo is a Chartered Accountant and has a track record of successfully scaling businesses and building brands. At Youi, he drives a strong culture and continues to push the boundaries as a challenger insurer.

Hugo holds Board positions on the Youi, Blue Zebra Insurance and AutoGuru boards.

NSW Labor’s Western Sydney flood package welcomed

by insuranceca

NSW Labor’s Western Sydney flood package welcomed

News release

Monday, 25 July, 2022

The announcement today that, if elected, a future New South Wales Labor Government would invest $225 million to make Western Sydney more resilient to flooding is a welcome first step, the Insurance Council of Australia (ICA) said today.

The $225 million Western Sydney Floods Resilience Plan announced by New South Wales Opposition Leader Chris Minns today includes a plan to invest $24 million to protect communities from large scale flooding by building new levees at Peachtree Creek, McGraths Hill and Pitt Town.

Some residents of Western Sydney have experienced flooding four times in the past two years, and the region is one of the most flood-prone in Australia.

The February-March 2022 floods were Australia’s most costly flood ever causing $4.8 billion in insured losses, approximately half of which was in New South Wales. The floods that impacted parts of New South Wales earlier this month have seen $145 million in damages in impacted parts of the State, including Western Sydney.

Earlier this year the Insurance Council released its Building a More Resilient Australia report, which called for $232 million to be jointly invested by the New South Wales and Federal Governments over five years to improve property resilience to flood, storm and bushfire.

Leading actuarial consultancy Finity estimated that this investment would save governments and communities $5.6 billion to 2050, 24 times a return on investment.

Building a More Resilient Australia also included a recommendation for a $532 million local infrastructure fund to support investment across the country in projects such as levees, seawalls and floodways.

New South Wales is the only mainland state – and will soon be the only state – to levy insurance customers to fund emergency services, adding 30 to 40 per cent to the cost a premium and driving down levels of insurance coverage.

Changes are also required to land use planning and building codes to make sustained improvements to community resilience.

Quote attributable to ICA CEO Andrew Hall:

Today’s announcement by New South Wales Labor is a welcome first step and shows that political stakeholders are heeding the resilience message insurers have been giving over a long period.

New South Wales is the highest-taxing state in the country when it comes to insurance, which drives down adequate coverage at a time and in a state where we need it most.

In the lead-up to next March’s state election the Insurance Council and insurers are calling on all parties to commit to abolishing this retrograde impost.

We look forward to the New South Wales Government’s response to the O’Kane / Fuller inquiry into the February-March floods, which must include significant investment in resilience measures and changes to land use planning.

Insurance Council of Australia Annual Report 2021

by insuranceca

Changes to Insurance Council of Australia Board

by Pha Tran

Changes to Insurance Council of Australia Board

News release

Wednesday, 15 December 2021

The Board of the Insurance Council of Australia (ICA) has appointed IAG Managing Director and CEO Nick Hawkins to the position of President at its December meeting.

QBE Australia Pacific CEO Sue Houghton will complete her term as President at the end of the year and remain on the Board. Mr Hawkins will commence as President on 1 January 2022.

Hollard Holdings Managing Director Richard Enthoven will continue as Deputy President.

Quote attributable to outgoing ICA President Sue Houghton:

Over the past two years insurers and the ICA have had to grapple with many significant issues, including the implementation of the Hayne Royal Commission reforms, the local impacts of a hardening global insurance market, and the business interruption test case process, just to name a few.

I’m proud of the way in which the industry, both individually and collectively through the ICA, has responded to these challenges, which has always been constructive and collaborative.

I have very much enjoyed my term as President of the ICA Board and know that in Nick I am handing the role on to very experienced hands.

Quote attributable to incoming ICA President Nick Hawkins:

Insurers have a unique role to play in this country to help reduce the risks many communities and businesses face from extreme weather and natural disasters, and this will be a key focus of the ICA Board as we head into 2022.

Sue has done an outstanding job as President and we’re grateful for her leadership.

I look forward to stepping into this important role in the new year.

Nicholas Hawkins, Managing Director and CEO, Insurance Australia Group Ltd

Nick Hawkins became IAG’s Managing Director and CEO in November 2020. He previously held the role of Deputy CEO, accountable for the management and performance of IAG’s day-to-day operations.

Nick previously spent 12 years as IAG’s Chief Financial Officer, responsible for the financial affairs of the company. Prior to this Nick was the Chief Executive Officer of IAG New Zealand and held a number of roles within finance and asset management since joining the Group in 2001.

Before joining IAG, Nick was a partner with KPMG. He is a Fellow of Chartered Accounts of Australia & New Zealand and a graduate of the Harvard Advanced Management Program.

- « Go to Previous Page

- Page 1

- Interim pages omitted …

- Page 3

- Page 4

- Page 5

- Page 6

- Page 7

- Go to Next Page »