Home Media releases Page 30

More than half of $5.4b East Coast Flood claims now closed

News release

Friday, 30 September 2022

The Insurance Council of Australia (ICA) today released new data showing more than half of insurance claims related to the February and March floods have been closed.

The latest figures reveal a 10 per cent increase from last month in claims closed, with $2.81 billion or 54 per cent of all claims now finalised for those customers impacted by Australia’s costliest flood.

Insured losses have increased slightly from last month to $5.45 billion from about 234,000 claims.

The time required to settle or resolve a claim depends on the type of claim, the assessment and analysis that’s required to make a claim decision, and the complexity of the repair or settlement. The more complex the analysis, assessment and rebuild required, the longer a claim will take to process.

Claims closure times are being impacted by the high volume of claims, a shortage of experts required to assess and manage flood claims, building labour and materials constraints, and the complexity of recovery and resilience programs delivered by both the Queensland and New South Wales governments.

The data update follows the release of the Insurance Council’s Insurance Catastrophe Resilience Report 2021-22 and research from the McKell Institute, which found extreme weather events over the past 12 months cost every Australian household an average of $1,532.

McKell’s The Cost of Extreme Weather report shows that over the last 10 years the average annual household cost of extreme weather has been $888, but that this figure is expected to jump to more than $2,500 a year by 2050.

Comment attributable to Andrew Hall, CEO, Insurance Council of Australia:

Insurers have been working hard to see claims settled and closed following the devastating February and March East Coast Floods, and we are confident this momentum will continue leading into summer.

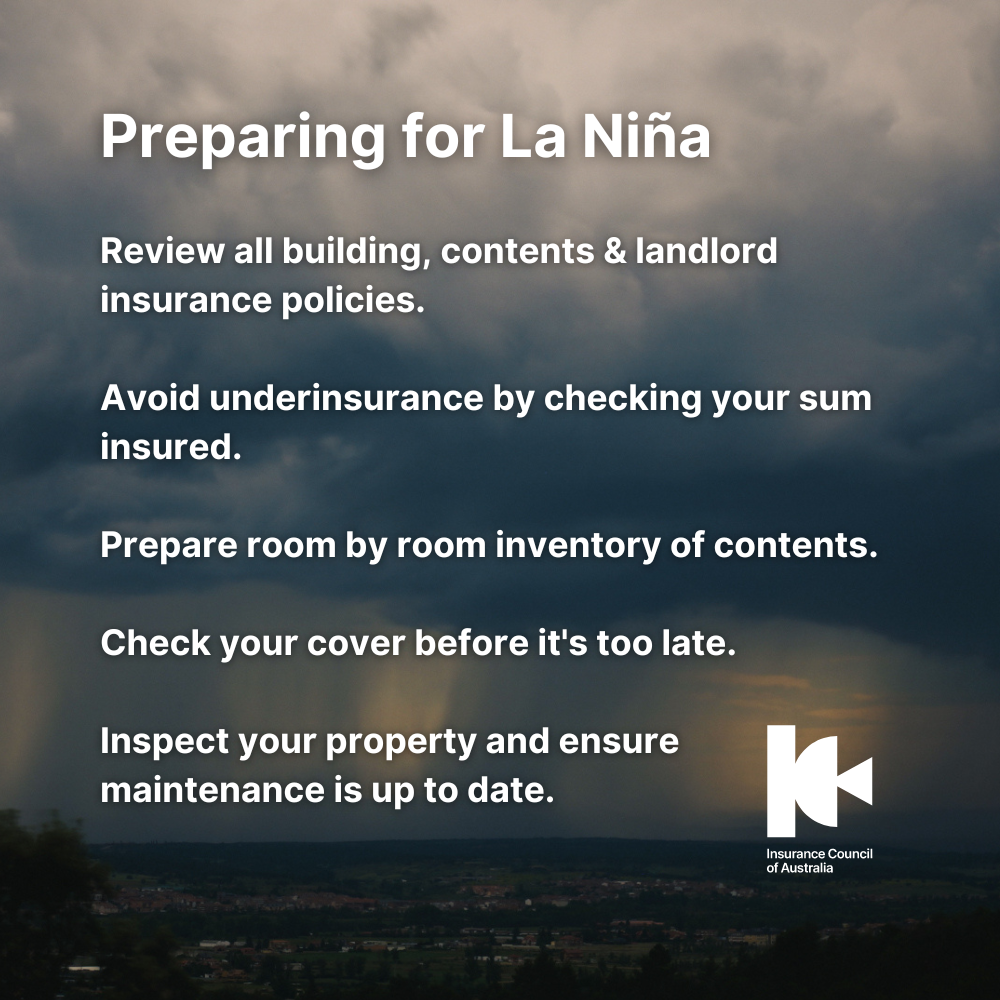

While we remain concerned that summer forecasts a continuation of La Niña conditions, insurers are geared up and working through the current claims as quickly as possible.

We encourage Queensland, New South Wales and the Federal Government to continue to expedite their build back and buy back programs as soon as possible to give those communities certainty.

Our recent reports and research show that these events are becoming increasingly costly for Australian households, and clearly demonstrate the impact of worsening extreme weather.

To ensure Australians continue to have access to affordable insurance protection, we must increase investment in the resilience of our built and natural environments, and, in parallel, address the underlying cause of more severe weather events.