Home Climate change Page 5

Green Star Homes

Partnership and Status: Complete

Overview

Buildings have an enormous impact on the health and wellbeing of our planet and ourselves. They offer an opportunity to reduce the impact to our environment through sustainable living.

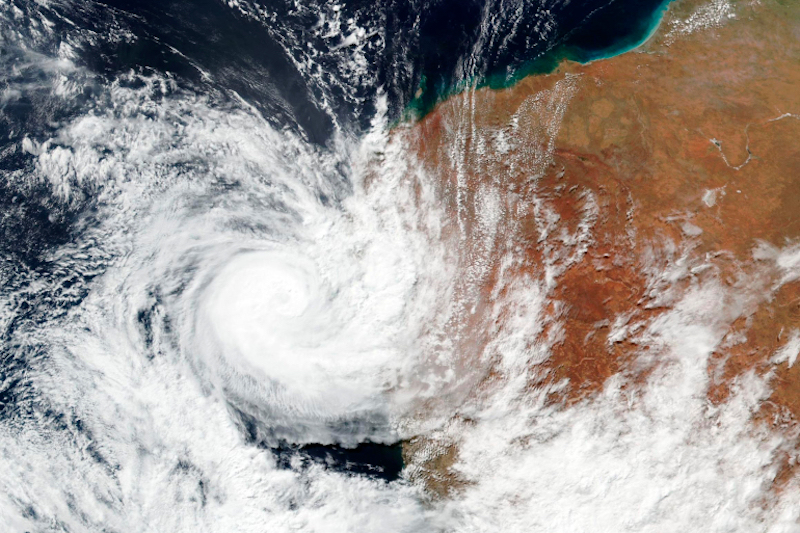

The ICA partnered with The Green Building Council of Australia (GBCA) on the Future Homes Initiative. The GBCA has developed the Green Star for Homes Standard to ensure Australian homes are ready to adapt to extreme weather challenges.

There are two parts to Green Star for Homes:

- Sets clear simple actions and targets for single family dwellings across health, efficiency, climate resilience and energy source.

- Introduces verification practices to be an effective, consistent and efficient mark of quality for your customers

The final Green Star Standard can be accessed here.

Partnerships

- The Green Building Council of Australia

- Emergency Management Australia (EMA) – Mitigation and Risk Sub-Committee (MaRS)