Home Climate change

Insurance industry taking strides towards net-zero, new report finds

News release

Tuesday, 10 December 2024

The Insurance Council of Australia (ICA) has today released the third edition of its award-winning Climate Change Roadmap, outlining the industry’s continued commitment to achieving net-zero.

The 2024 update of the Climate Change Roadmap, Towards a Net-Zero and Resilient Future, includes member survey results which found that 85 per cent of respondents have set net-zero targets by 2050, with 50 per cent aiming for 2030 operational net-zero targets. The survey also found that 63 per cent have linked climate metrics to executive pay.

The roadmap highlights steps the industry has taken to prepare for mandatory climate disclosure requirements that are coming into force nationally for most major Australian businesses in early 2025. More than half of survey respondents have already been subject to these requirements in other jurisdictions.

Examples of member innovation where insurers are incentivising sustainable home renovations and bushfire resilience are also explored. These are not only helping insurers progress their own emissions goals but also helping to mitigate risk and moderate premium costs for customers.

Across the year, the ICA has increased its support to members in this space, including:

• Convening a National Industry Roundtable on land use planning and resilience.

• Developing best practice guides on emissions target setting, transition plans, and nature-positive insurance.

• Expanding focus on global best practices and lessons from other jurisdictions.

• Leading an international delegation to the US, including insurers, elected officials, and department representatives, which examined policy responses to worsening extreme weather.

The Insurance Council advocates on behalf of its members and their customers for policy settings that accelerate Australia’s transition to net-zero.

In 2023, the Climate Change Roadmap won the Sustainability Award at the 27th Asia Insurance Industry Awards, judged by 26 panellists across the insurance industry globally and audited by KPMG.

Quotes attributable to Andrew Hall, CEO Insurance Council of Australia:

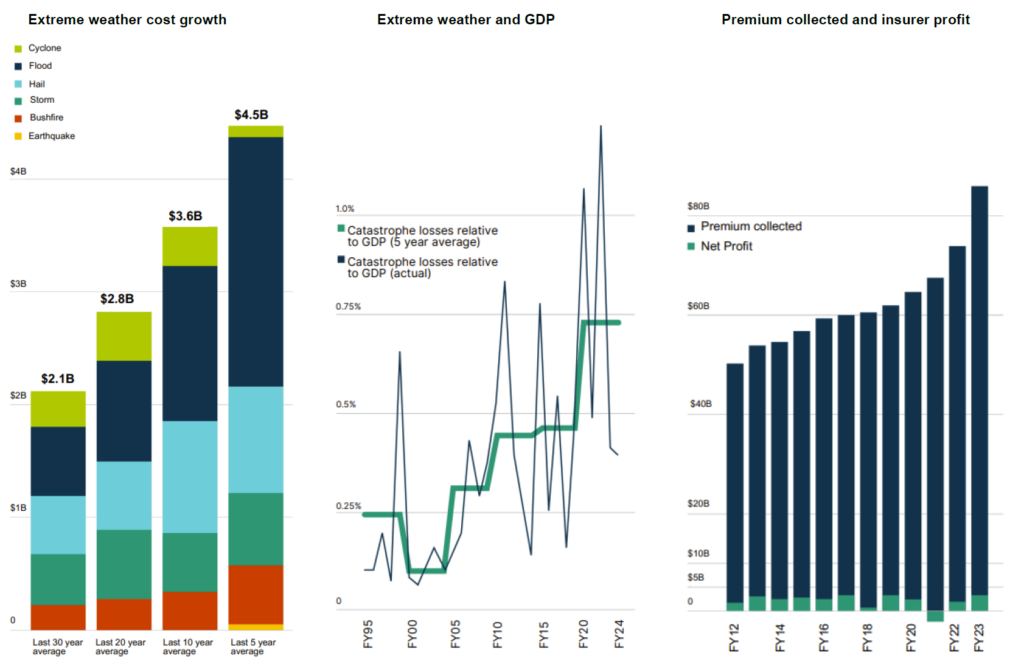

The insurance industry is the financial shock absorber of the impacts of extreme weather events, which is expected to cost Australia $35.2 billion a year by 2050.

Extreme weather events are costing Australian homeowners approximately $4 billion a year, highlighting the need for greater action to future proof Australia’s resilience in the face of worsening bushfires, cyclones and floods.

Our members are stepping up to the plate by preparing for climate disclosures and taking action now to reduce emissions.

Each update we make to this important Roadmap will help ensure it reflects current best practice and industry progress.