Home Types of insurance Page 4

Travel insurance is as important as your passport

Things we take for granted in Australia, such as the public health system, are not free or even available to you once you leave the country. Personal responsibility plays a big part in your travel plans and it’s important to read the details of your policy, so you know you are covered.

Travel insurance is as important as your passport – it can provide valuable protection in the event of an unexpected event, such as a medical emergency, lost luggage, or flight cancellation.

New stats show not enough Australians are travelling with adequate insurance

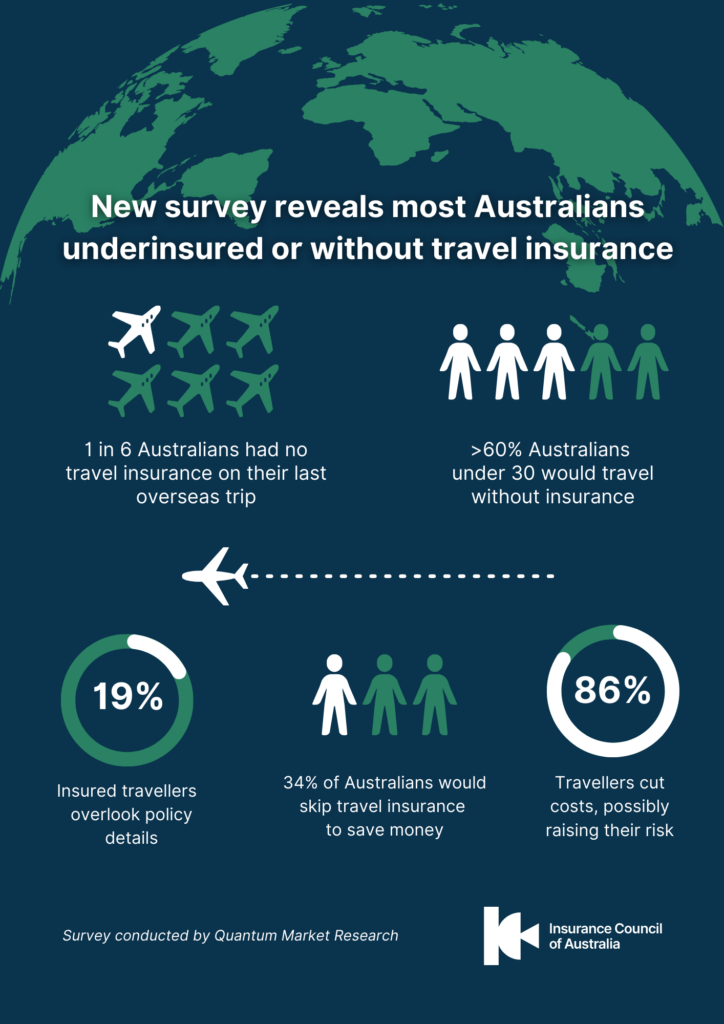

Recent survey conducted at the end of 2023 revealed:

- One in six (16%) Australians were not covered by any form of travel insurance on their last overseas trip.

- Younger travellers (aged under 30) were most likely to travel without insurance (60%).

- Even among insured travellers, many are overconfident about their coverage and have not properly read their policy documents (19%).

- The rising cost of travel is prompting more Australians to travel without insurance or to take risks that may not be covered (34%).

- The majority (86%) of travellers will find ways to keep costs down while traveling, which may increase their exposure to risk.

Read your policy to ensure you're covered for your holiday

Exclusions often apply to 'high risk' activities, illness caused by pre-existing medical condition, claims for travel to areas where an official travel warning has been issued, among other things depending on your insurer or policy, so it's essential travellers familarise themselves with their policies.

Most travel insurance policies have exclusions for outbreaks of infectious diseases, pandemics, epidemics and/or known events. However, there are policies available that offer cover for some Covid related events including medical expenses, cancellation and additional accommodation costs.

Travel insurance tips

- To find the appropriate travel insurance for your trip, research the available policies.

- Read the product wording carefully and check all conditions, inclusions, and exclusions.

- Dangerous, negligent, or risky activities are often excluded, so be safe and check your policy wording.

- Customers are advised to review Australian Government advisories regarding travel.

This survey of 1,000 travellers, was conducted by Quantum Market Research on behalf of the Insurance Council of Australia and the Department of Foreign Affairs and Trade’s Smartraveller in late 2023.