Home Disaster & catastrophes Page 2

Recovery underway following ex-TC Alfred

News release

Thursday, 13 March 2025

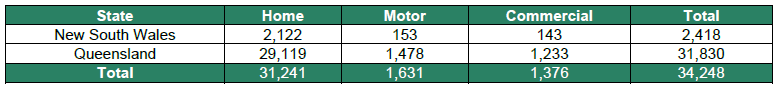

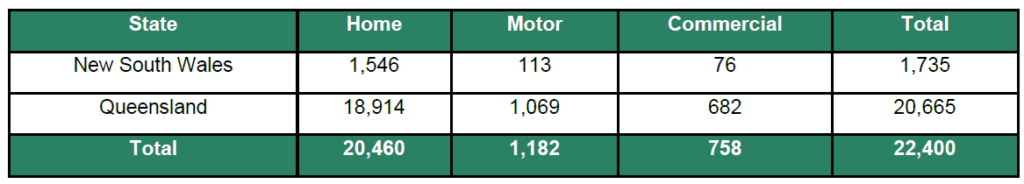

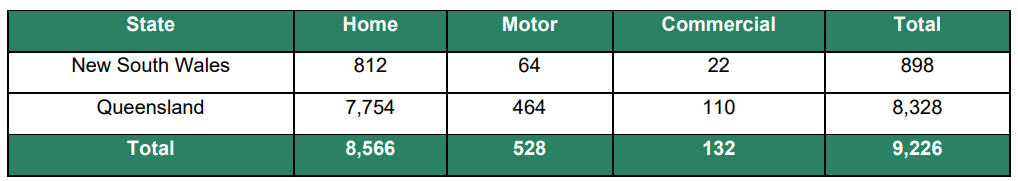

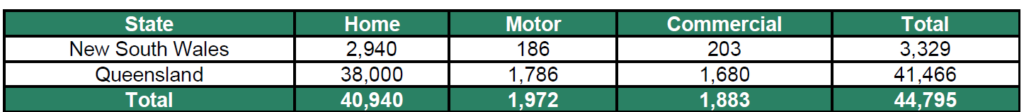

Insurers have received more than 44,000 claims following ex-Tropical Cyclone Alfred, the Insurance Council of Australia (ICA) reported today.

While claims types differ from region to region, pre-event concerns about large numbers of severe wind damage claims have not been realised, with some customers in localised areas making flood claims and many more thousands of customers across the path of the event making claims related to storm-driven water damage and food spoilage due to power outages.

Insurers are on the ground assisting customers across the impacted zones, with boots on the ground in Coffs Harbour, Lismore, Ballina and Tweed Heads in New South Wales, and across Redlands, Hervey Bay, Logan, Brisbane and the Gold Coast in Queensland.

Claims made by policyholders across New South Wales and Queensland are being prioritised by insurers with additional claims consultants stood up and interstate builders sourced.

The ICA is also continuing to remind locals about the presence of ‘disaster chasers’ operating in impacted communities.

Disaster chasers may offer to undertake work such as tree and debris removal, requesting payment upfront in cash but often leaving work poorly done or incomplete. They can often pressure homeowners to sign a contract on the spot for future repair work and may promise their insurer will pay.

Insurers will only pay for approved work that is covered by a policy. Anyone uncertain should seek guidance directly from their insurer.

Quote attributable to Andrew Hall, CEO, Insurance Council of Australia:

While the devastation caused by ex-TC Alfred wasn’t as significant as predicted, we know that for many, the road to recovery will still be a long one.

I want to assure impacted communities that insurers are working hard to assess claims and get people back on their feet as soon as possible. It’s the reason insurance exists.

We’re continuing our engagement with all levels of government and response agencies and this will remain throughout the region’s recovery process.

A more detailed claims breakdown is outlined in the table below.

Frequently Asked Questions

Lines below can be used by media and attributed to a spokesperson from the ICA:

What are insurers doing in response to this weather event?

Insurers have pre-emptively contacted more than a quarter of a million customers across south-east Queensland and northern New South Wales with safety and preparedness tips and how to lodge a claim as quickly as possible. Insurers added hundreds of additional claims consultants, engaged round-the-clock major event response teams during the active phase of the event, pre-reserved temporary accommodation for impacted customers, and secured a strong network of builder and supplier capacity in potentially impacted areas.

How should policyholders approach the clean-up process?

If you've been given the go-ahead to return to your property, you can clean up if it's safe to do so, but check out these tips first.

- Remain mindful of safety

- Before you start your cleanup, document the damage with photos and videos to support an insurance claim.

- Take photos before removing any water damaged or soaked items that may pose a health risk.

- Make a list of damaged items, including the brand, model and serial number if you can.

- Don't throw away items that could be repaired unless they pose a health risk.

- Speak to your insurer before you attempt or authorise any building work, including emergency repairs, and ask for the insurer’s permission in writing, as unauthorised work may not be covered by your policy.

How much will the total damage bill for TC Alfred amount to?

It is currently too early to tell the impact that TC Alfred will have and what the total damage bill will be.

The last cyclone to cause significant damage in Australia, Tropical Cyclone Jasper (2023), cost $409 million from around 10,500 claims.

The costliest cyclone to hit Australia remains Cyclone Tracy (1974), which normalised to 2023 values would incur $7.4 billion in claims.

The floods of early 2022 remain the costliest insured event in Australia’s history with $6.4 billion in insured losses across more than 245,000 claims.

Is cyclone damage typically covered under standard home and contents policies?

Most standard home and contents policies in Australia will cover damage caused by cyclones but this is something customers should clarify with their own insurer or by reading their product disclosure statement. However, some customers may have opted out of flood cover. Customers are encouraged to contact their insurer if they want to better understand what they are covered for.

Who are ‘disaster chasers’?

‘Disaster chasers’ typically present themselves in a disaster impacted area shortly after an event occurs but can also appear months later. They may door knock neighbourhoods, claiming to have identified damage at your property or premises, or in some very bold cases they may claim that they are here at the behest of your insurance company.

Disaster chasers might do the following:

- Claim to be able to identify damage to your property that you were unaware of, sometimes by way of a free inspection

- Ask for money up front

- Promise to get the repairs done in a short amount of time

- Promise to get the repairs done for an amount that is far below legitimate competitors’ bids

- Not have insurance or necessary licenses

- Ask you to sign a contract, on the spot

- Claim that they will be able to get your insurer to pay more for an insurance claim than you could manage yourself

Top tips for identifying or dealing with a disaster chaser:

- Insurers will not send a tradesperson or builder to your property or premises without notifying you and providing you with details.

- Speak to your insurer before agreeing to any repairs or rebuilding work to make sure your insurer will cover it.

- If in doubt, ask for identification such as a builder’s licence or driver’s licence, and ring your insurer to check.

- Don't sign contracts with a disaster chaser if they door knock.

- If you have signed a contract, there is a cooling -off period, your insurer can help you end the relationship with the disaster chaser.

If in doubt, report any suspicious activity to government authorities or police.

How many homes/businesses are at risk of flood?

Floods pose a critical threat to Australia. Around 1.36 million properties across the country face some risk of flooding, and it is estimated that half of these properties fall short of the flood resilience measures of modern planning and building standards. Around 298,000 of these properties – approximately 225,000 homes and 73,000 businesses – face at least a two or five per cent chance of flooding each year. 91,000 of these are in Queensland.

There is a clear correlation between high flood exposure and low socioeconomic status. Analysis of the 2024 National Flood Information Database (NFID) indicates that approximately 70 per cent of households exposed to the highest flood risk are in areas where the median income is below the national median ($92,000), and around 35 per cent of these households are in areas where the median income is below the poverty line ($58,000).

Of the estimated 225,000 homes in the highest flood risk locations across the country, only around 23 per cent have flood cover, compared to an estimated 60 per cent nationwide.

In February 2025, the Insurance Council released its Federal Election Platform which included a call for a Flood Defence Fund at a cost of $30.15 billion over ten years, shared by the Federal Government and the state governments of Queensland, New South Wales and Victoria, which would:

- Deliver new critical flood defence infrastructure ($15 billion)

- Strengthen properties in harm's way ($5 billion)

- Managed relocation (buy-backs) ($10 billion)

- Future-proof existing flood mitigation infrastructure ($150 million)

Some locations have been hit by flooding/high premiums which aren’t on the ICA’s Flood Defence Fund list (identified above), are those areas not deserving of government support?

The National Flood Defence Fund targets the locations with the highest flood risk nationally, when our population is particularly concentrated and where we know insurance affordability is a challenge. The proposed fund currently targets the majority of flood catchments that have been affected by Ex Cyclone Alfred, including Maroochy, Brisbane, Longan-Albert, South Coast (Gold Coast), Condamine-Culgo, Tweed, Clarence and Richmond

Of course, risk changes overtime, which is why the flood defence infrastructure pipeline should be annually reviewed against key criteria including evolving flood risk, population growth, maintenance of flood infrastructure and the establishment of household resilience programs. It also sits alongside existing government grant and resilience programs which target areas outside of the Flood Defence Fund.

Will insurance premiums increase as a result of TC Alfred?

It is too early to predict what impact it will have on premiums. However, the frequency and severity of natural disasters has increased in recent years and this is contributing to higher premiums. Insurers have been calling on governments to invest more in resilience and mitigation to protect the many Australians who are living in harm’s way and improve insurance affordability and availability – as outlined by our call for a Flood Defence Fund in our Federal Election Platform released in February.

How much of a premium goes to the state government in tax?

In every state and territory in the country (except the ACT), governments not only collect GST on a premium, but state governments also collect stamp duty, meaning policyholders are double-taxed. This is exacerbated in NSW where policyholders pay an additional tax in the Emergency Services Levy. In the last financial year, state governments collected almost $8.6 billion in taxes on insurance premiums, with ESL alone totalling more than $1.5 billion.

The ICA has long been advocating for tax reform to help lower premiums. If state governments abolished stamp duty, premiums across the country could be reduced by nine to 30 per cent immediately.

What does it mean when the ICA officially declares an Insurance Catastrophe (CAT)?

The ICA’s catastrophe declaration serves to escalate and prioritise the insurance industry’s response for affected policyholders. This will activate special services and support for homeowners and businesses within the official declaration zone.

Under the Catastrophe declaration:

- Claims from affected policyholders will be given priority by insurers.

- Claims will be triaged to direct urgent assistance to the worst-affected property owners.

- ICA representatives will be mobilised to work with local agencies and services and affected policyholders as soon as emergency services say it is safe to do so.

- Insurers will mobilise disaster response specialists to assist affected customers with claims and assessments as soon as emergency services say it is safe to.

- An industry taskforce has been established to identify and address issues arising from this catastrophe.