Home Disaster & catastrophes Page 15

East Coast flood event insurance update – 9 March

News release

Wednesday, 9 March 2022

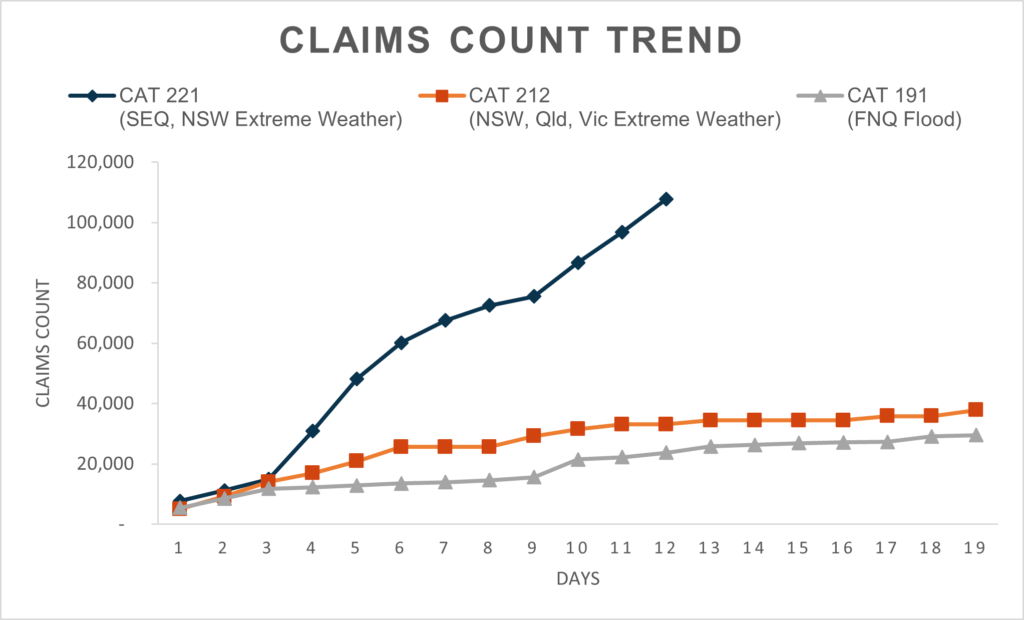

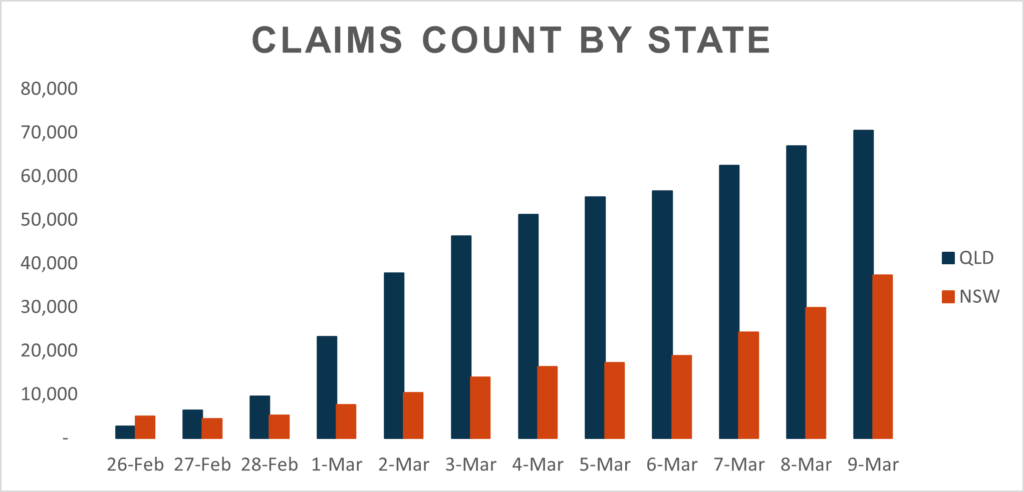

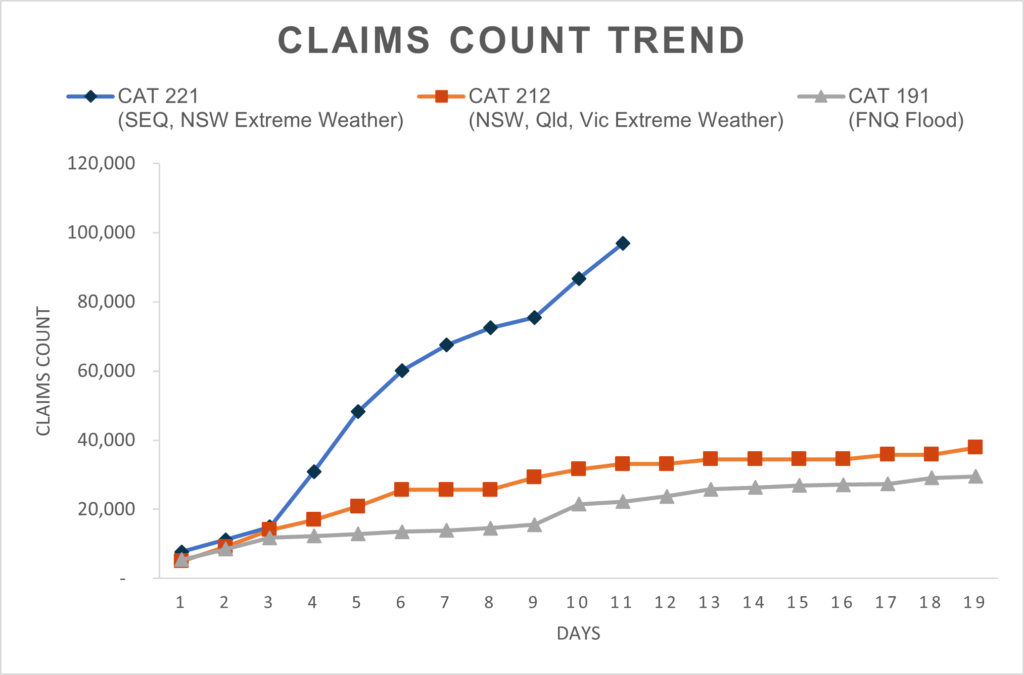

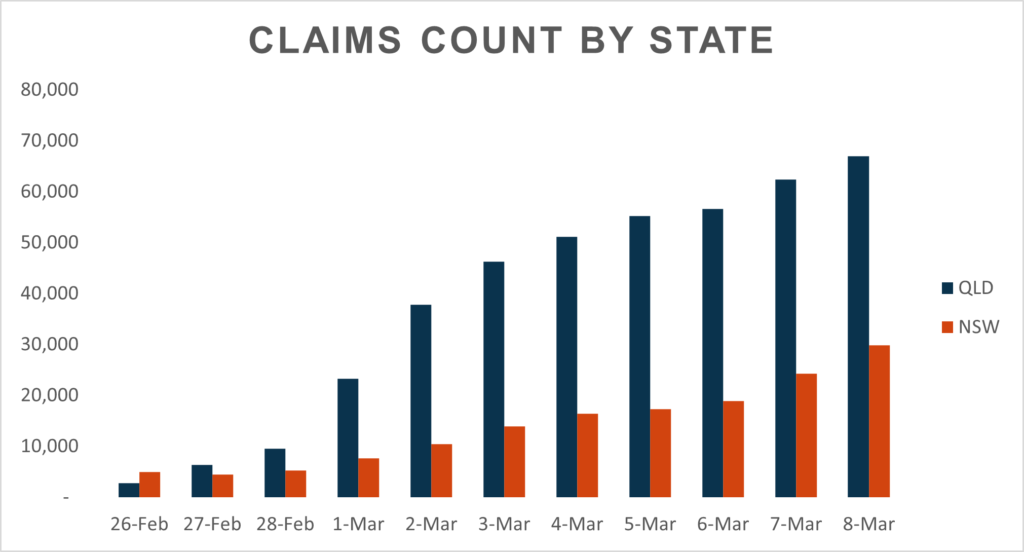

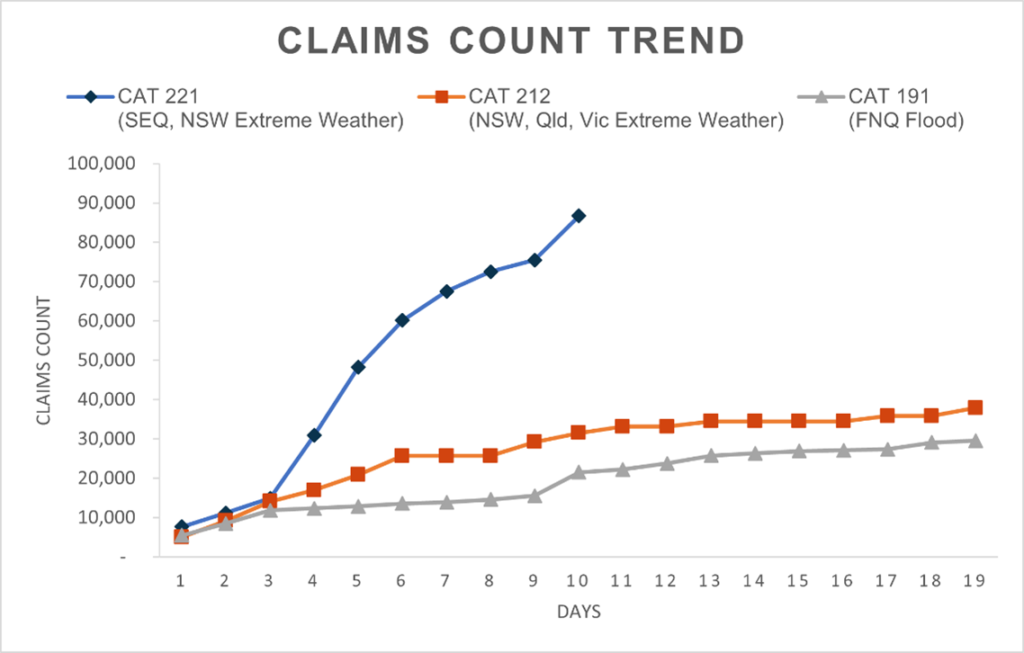

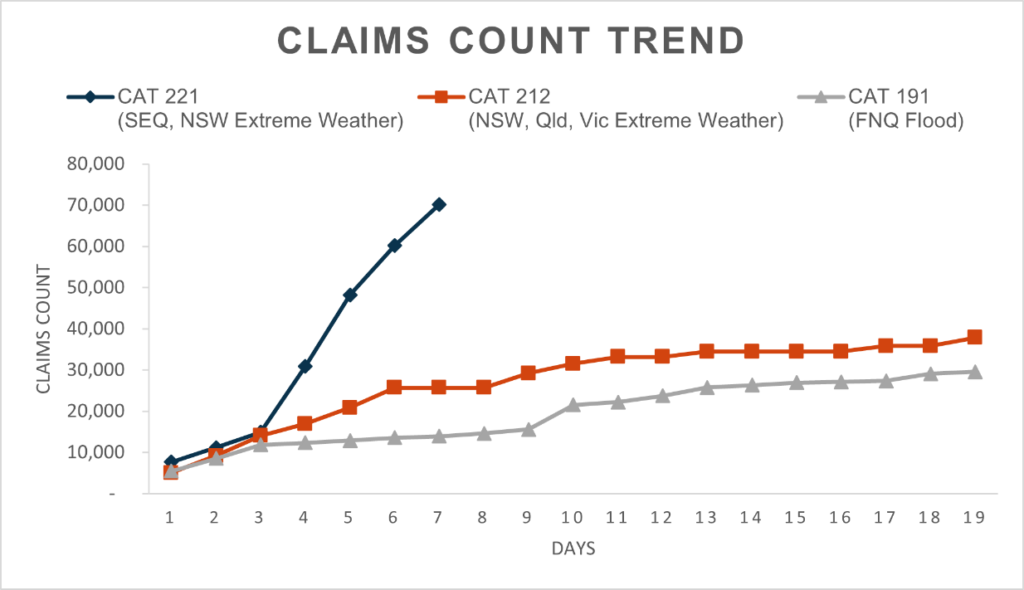

The Insurance Council of Australia (ICA) today said insurers have to date received 107,844 claims related to the South-East Queensland and New South Wales floods.

This is an 11 per cent increase on yesterday’s claims count, driven by a 25 per cent increase on yesterday’s figures in the number of claims from New South Wales. (See graphs below)

Sixty-five per cent of claims are from Queensland and 35 per cent are from New South Wales.

Across both States 80 per cent of claims are for domestic property, 17 per cent of claims are for motor vehicles, and three per cent are commercial property claims.

Based on previous flood events the estimated current cost of claims is now $1.62 billion.

This figure remains subject to detailed assessment of claims as loss adjustors move in over the coming weeks and will increase as further claims are made.

The Insurance Council welcomes the Federal Government’s declaration today of a national emergency, which reflects the extent and severity of the disaster.

Greater funding for support measures, clean-up and recovery is welcomed.

Once this initial phase passes it is vital that funding for measures that improve protections against the impacts of similar events into the future must also be addressed.

The Productivity Commission has found that across Australia 97 per cent of natural disaster funding is spent after an event, with just three per cent spent on measures to improve community resilience ahead of an event.

The Insurance Council and insurers have consistently called for an increase in Federal Government investment in this area to $200 million per year, matched by the states and territories.

State taxes and charges on insurance, land use planning and building codes also need to be urgently addressed if we are to make real changes to the nation’s resilience to worsening extreme weather.

Quote attributable to Andrew Hall, CEO, Insurance Council of Australia:

Yesterday’s wild weather in New South Wales has seen a big lift in claims from that State, and as the insured damages bill passes $1.5 billion we can see that this event is shaping up to be one of Australia’s most expensive floods.

The Insurance Council welcomes the Prime Minister’s announcement today of a national emergency declaration.

It is important for policyholders to note that a declaration by any government or indeed the Insurance Council has no effect on the application or coverage of a policy, including the excess if there is one.

The General Insurance Industry Code of Practice commits insurers to respond to catastrophes efficiently, professionally, practically, and compassionately.

What to do if your property has been impacted by flooding and storms

- You can start cleaning up but first take pictures or videos of damage to the property and possessions as evidence for your claim

- Keep samples of materials and fabrics to show your insurance assessor

- Remove water damaged goods from your property that might pose a health risk, such as saturated carpets and soft furnishings

- Make a list of each item damaged and include a detailed description, such as brand, model, and serial number if possible

- If water has entered the property, do not turn on your electricity until it has been inspected by an electrician

- Store damaged or destroyed items somewhere safe where they do not pose a health risk

- Speak to your insurer before you attempt or authorise any building work, including emergency repairs, and ask for the insurer’s permission in writing. Unauthorised work may not be covered by your policy

- Do not throw away goods that could be salvaged or repaired