Tuesday, 8 March 2022

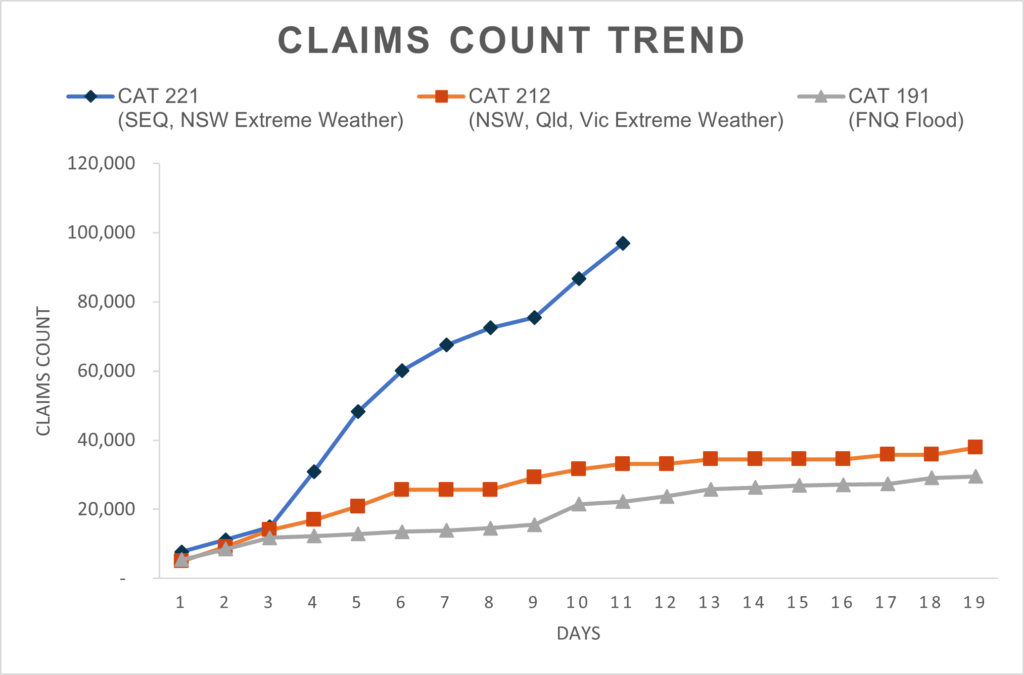

The Insurance Council of Australia (ICA) today said insurers have to date received 96,844 claims related to the South-East Queensland and New South Wales floods.

This is a 12 per cent increase on yesterday’s claims count, driven by a 23 per cent increase on yesterday’s figures in the number of claims from New South Wales. (See graphs below)

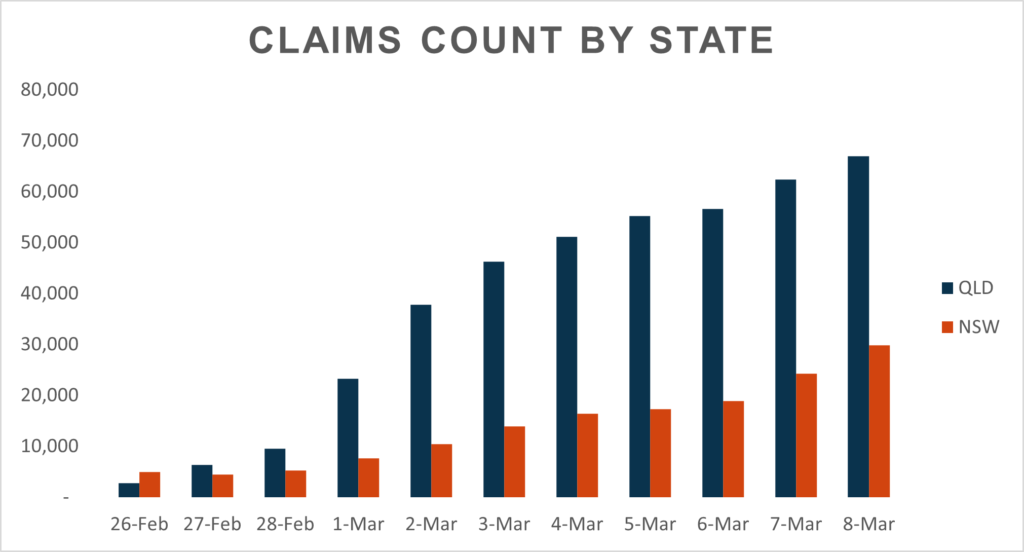

Sixty-nine per cent of claims are from Queensland and 31 per cent are from New South Wales.

Across both States 80 per cent of claims are for domestic property, 17 per cent of claims are for motor vehicle, with the remainder commercial property claims.

Claims have been received from 80 local government areas.

Based on previous flood events the estimated current cost of claims is now $1.45 billion.

This figure remains subject to detailed assessment of claims as loss adjustors move in over the coming weeks and is expected to increase as further claims are made.

Under Insurance Catastrophe protocols agreed by the industry, insurers prioritise the most urgent and most vulnerable customers when assessing claims.

This means some customers whose situation is not as urgent or severe (i.e., their home is habitable) may need to wait a few weeks until an assessor is able to review their claim.

The ICA has been working with Federal authorities to expedite the processing of visas for key insurance recovery personnel being deployed to Australia from overseas to assist with the recovery effort.

All visa applications provided have been processed and insurers are grateful for the support received by the Department of Home Affairs and Immigration Minister Alex Hawke.

ICA CEO Andrew Hall will be in Lismore from this afternoon meeting with local MPs, stakeholders and insurers.

Quote attributable to Andrew Hall, CEO, Insurance Council of Australia:

As we expected we are now seeing an influx of claims from New South Wales.

Insurers are prioritising those customers whose situation is the most severe to support them getting back on their feet as soon as possible.

This means it may take a few weeks for insurers to start the assessment process for less severe claims, but those customers can be assured their insurer is there to support them.

Insurers rely on a network of specialists from across the country and around the world who are deployed when and where they are needed.

I want to thank Immigration Minister Alex Hawke, his office, and department for their support in quickly processing a number of visa applications, which means those specialists will be on ground shortly assisting communities in their recovery.

What to do if your property has been impacted by flooding and storms

- You can start cleaning up but first take pictures or videos of damage to the property and possessions as evidence for your claim

- Keep samples of materials and fabrics to show your insurance assessor

- Remove water damaged goods from your property that might pose a health risk, such as saturated carpets and soft furnishings

- Make a list of each item damaged and include a detailed description, such as brand, model, and serial number if possible

- If water has entered the property, do not turn on your electricity until it has been inspected by an electrician

- Store damaged or destroyed items somewhere safe where they do not pose a health risk

- Speak to your insurer before you attempt or authorise any building work, including emergency repairs, and ask for the insurer’s permission in writing. Unauthorised work may not be covered by your policy

- Do not throw away goods that could be salvaged or repaired