Monday, 19 August 2024

New data released by the Insurance Council of Australia (ICA) today shows that the impact of extreme weather on the Australian economy has more than tripled over the last three decades.

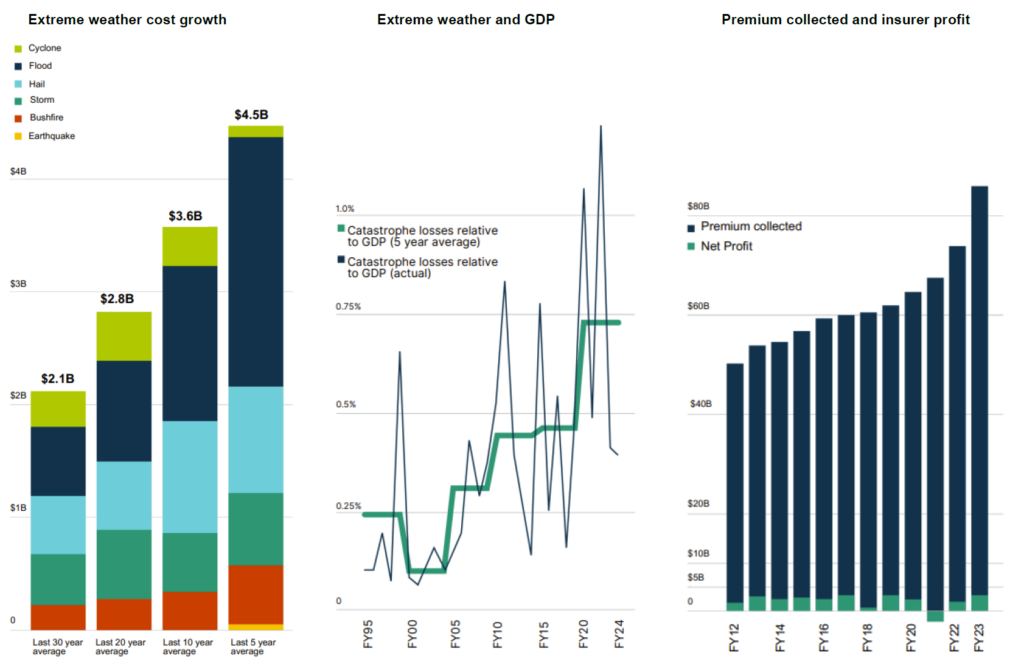

Insured losses from declared insurance catastrophes have grown from 0.2 of GDP from 1995 to 2000 to 0.7 per cent for the last five years, meaning extreme weather losses are consuming more and more of our economic resources.*

In monetary terms, over the last 30 years insurers paid an average of $2.1 billion per year to customers impacted by extreme weather events, but looking at just the last five years the average annual cost of extreme weather claims has more than doubled to $4.5 billion, driven largely by the growing cost of flood.**

And while total premium collected by insurers has grown from $50 billion in 2012 to $86 billion in 2023 insurer profits have not kept pace, remaining flat over that period.***

The new data analysis is contained in the Insurance Council of Australia’s Insurance Catastrophe Resilience Report 2023-24, released today.

The Report shows that insurers incurred $2.19 billion in claims from declared extreme weather events in 2023-24, the same amount as was incurred from extreme weather events over the previous 12 months.

However, the number of claims from events in the past 12 months was almost 157,000, 66,000 more claims than the previous period, showing that while the average claim from recent weather events was lower the impact was more widespread.

The costliest extreme weather event of the past 12 months was the Christmas storms that impacted the Gold Coast hinterland as well as areas of New South Wales and Victoria, which drove $1.33 billion in claims.

The event with the greatest impact on individual customers was ex-TC Jasper which hit Far North Queensland in mid-December, where the average claim was $36,000, almost three times the average claim for the Christmas storms.

The Report outlines the policy solutions required to improve community and household resilience to extreme weather, which include improved land use planning, stricter building codes, and ongoing investment in resilience measures such as flood levees and home strengthening.

The Insurance Catastrophe Resilience Report 2023-24 will be launched at Parliament House, Canberra tonight.

www.insurancecouncil.com.au/CatastropheReport

Quote attributable to ICA CEO Andrew Hall:

The ICA’s latest Insurance Catastrophe Resilience Report shows the impact of extreme weather on our communities over the past 12 months.

Flood is Australia’s most costly natural peril, and it’s estimated that around 1.2 million properties face some level of flood risk.

Around 230,000 of these have a 1 in 20 chance of a flooding each year, with a further 420,000 properties facing a 1 in 50 or 1 in 100 annual chance of flooding, odds that translate into higher premiums which can lead to a growing protection gap.

In the last few years Australian policymakers have started to think more seriously about this issue, and in many ways we are leading the world in our approach to extreme weather risk mitigation and insurers’ product offerings that respond to these risks.

But we need to redouble our efforts if we are to manage the impact of worsening extreme weather amid a changing climate.

De-risking is the only sustainable way to reduce the pressure on premiums and close the protection gap: improved planning so no more homes are built in harm’s way, stronger buildings that are better able to withstand extreme weather, greater investment in public infrastructure to protect communities, and an ongoing program of home buybacks where no other mitigation is possible.

*ICA Catastrophe Loss data (5-year average) relative to GDP (GDP Index, ABS)

**ICA Catastrophe Loss data, adjusted for CPI

***Estimated from APRA’s published gross earned premium and increased for taxes and charges