Home Media releases Page 39

East Coast flood event insurance update – 7 March

News release

Monday, 7 March 2022

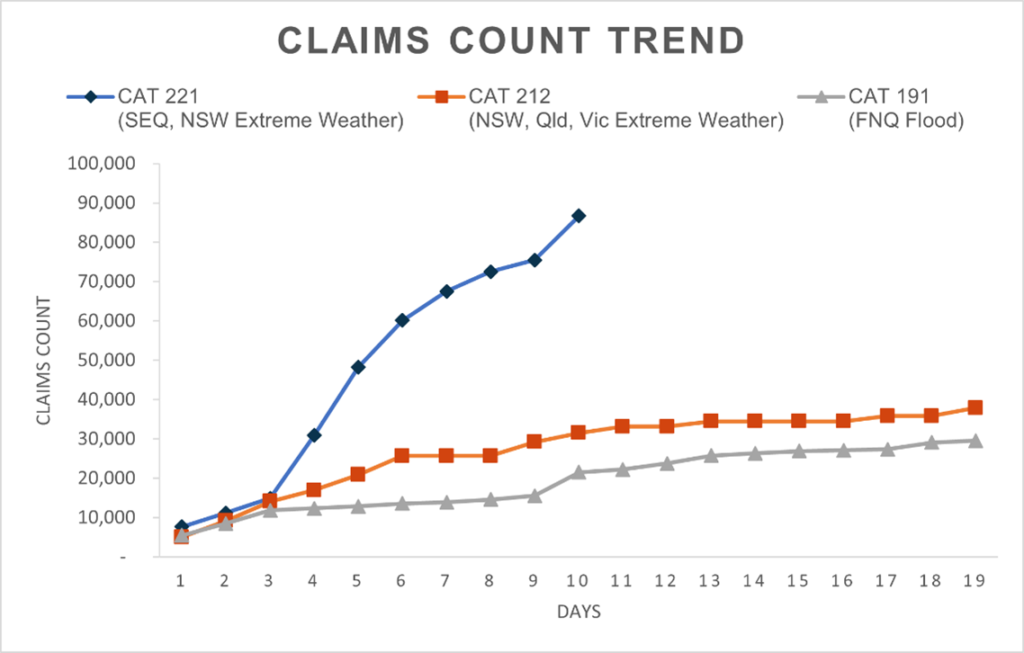

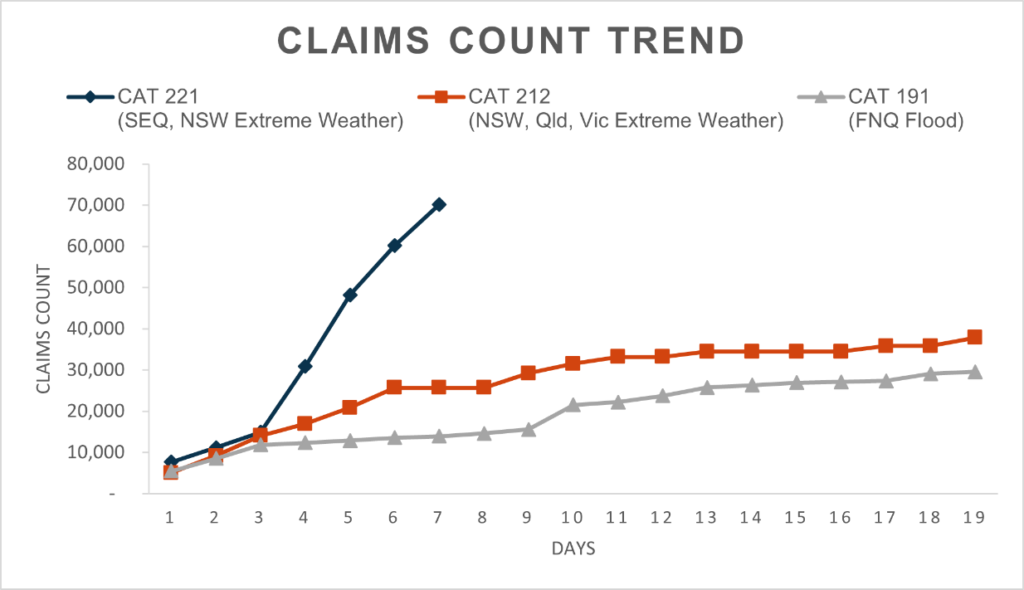

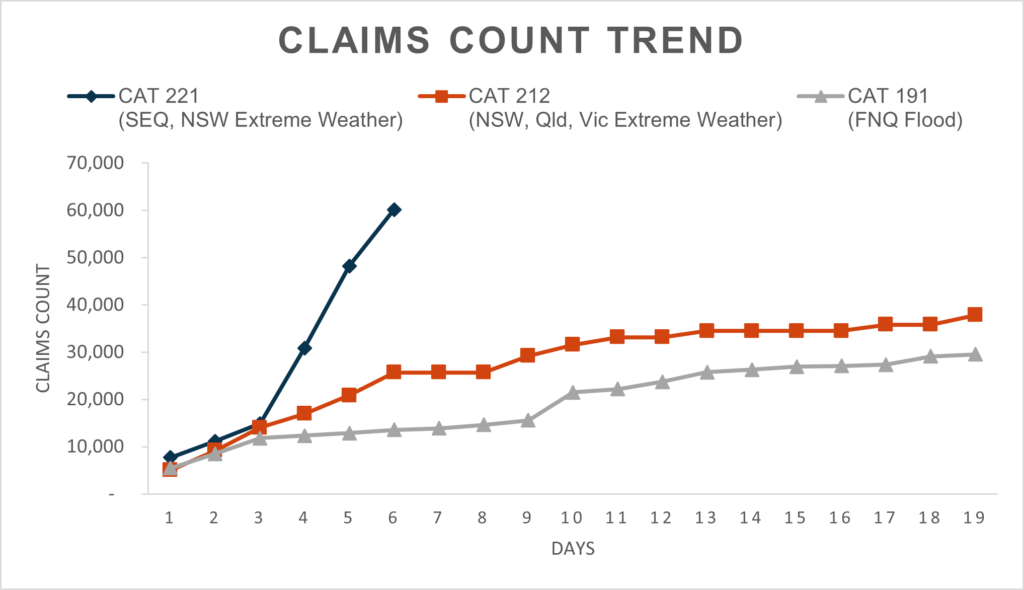

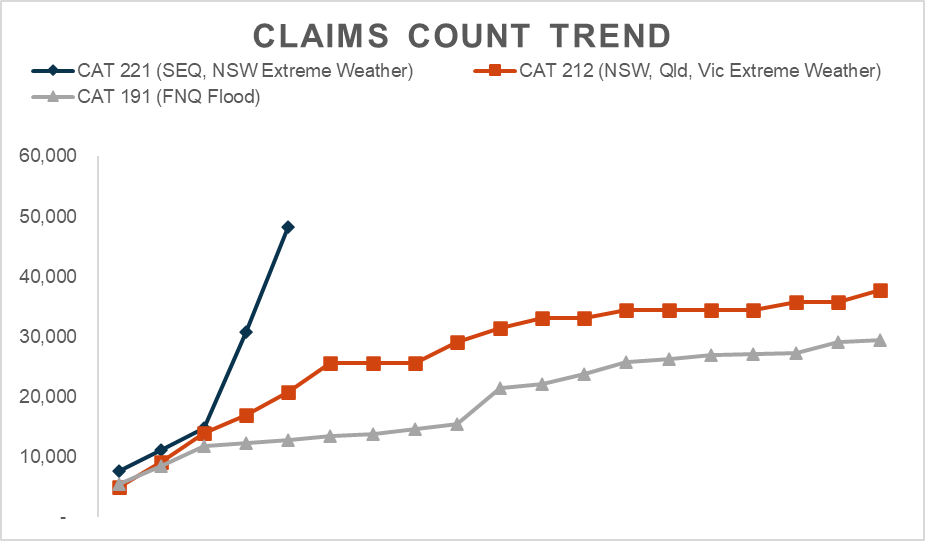

The Insurance Council of Australia (ICA) today said insurers have to date received 86,703 claims related to the South-East Queensland and New South Wales floods.

This is a 28 per cent increase on Friday’s claims count, driven by a 49 per cent increase in the number of claims from New South Wales as policyholders return to their properties in that State. (See graph below)

Seventy-two per cent of claims are from Queensland and 28 per cent are from New South Wales.

Across both States 83 per cent of claims are for domestic property, with the remainder motor vehicle.

Based on previous flood events the estimated current cost of claims is now $1.3 billion.

This figure remains subject to detailed assessment of claims as loss adjustors move in over the coming weeks and is expected to increase as further claims are made.

The ICA and insurers are reminding customers that they are not required to keep destroyed property, including carpet and furnishings, and instead should take photos, note any identifying information, and keep material samples.

Insurers and the ICA now have a presence at a number of recovery centres, however the very large number of impacted towns across two States means insurers may not be at all recovery centres at all times but are working collaboratively to respond to customer concerns regardless of insurer.

App, online or phone is always the most efficient way for customers to engage with their insurer, however if a customer attends a recovery centre and their insurer is not in attendance at that time they can pass on their details to another insurer or the ICA.

Insurers continue to work alongside Local, State and Federal Government stakeholders and agencies to resolve any issues as soon as they are known, and are monitoring the impact of the weather system currently impacting Sydney and surrounds and the New South Wales Mid-North Coast.

Quote attributable to Andrew Hall, CEO, Insurance Council of Australia:

The ICA and insurers are now on the ground in a number of locations supporting communities in their recovery.

We continue to hear reports that some customers are uncertain about whether to discard destroyed property.

Insurers are encouraging customers to take photos and video and retain serial numbers and other identifying information if it is known, however they are not required to retain destroyed property, particularly if doing so would cause a health risk.

As expected, claims continue to grow from this widespread event, which is shaping up to be one of the most significant floods this country has experienced.

We will always have extreme weather in Australia, but if we want different outcomes the future Australian governments must increase investment in measures to retrofit homes and better protect communities.

Remember

- Safety is the priority – don’t do anything that puts anyone at risk

- Only return to your property when emergency services give the go ahead

- If water has entered the property, don't turn on your electricity until it has been inspected by an electrician

- Contact your insurance company as soon as possible to lodge a claim and seek guidance on the claims process

- Property owners who have sustained roof damage should advise their insurer, your insurer will arrange emergency works to minimise any hazards and prevent further damage. This can include isolating damaged solar panels or electrical circuits and installing a roof tarp

- Don’t worry if you can’t find your insurance papers – insurers have electronic records and need only your name and address

What to do if your property has been impacted by flooding and storms

- You can start cleaning up but first take pictures or videos of damage to the property and possessions as evidence for your claim

- Keep samples of materials and fabrics to show your insurance assessor

- Remove water damaged goods from your property that might pose a health risk, such as saturated carpets and soft furnishings

- Make a list of each item damaged and include a detailed description, such as brand, model, and serial number if possible

- If water has entered the property, do not turn on your electricity until it has been inspected by an electrician

- Store damaged or destroyed items somewhere safe where they do not pose a health risk

- Speak to your insurer before you attempt or authorise any building work, including emergency repairs, and ask for the insurer’s permission in writing. Unauthorised work may not be covered by your policy

- Do not throw away goods that could be salvaged or repaired