Home Underinsurance

It’s time to safeguard your home and be bushfire ready

News release

Wednesday, 20 September 2023

As summer approaches, the Insurance Council of Australia is emphasising the need for early bushfire preparation so property owners and tenants can reduce risk and safeguard their homes and property.

Following three consecutive years of La Niña the Bureau of Meteorology has formally declared an El Niño event, coinciding with severe weather warnings and alerts for large parts of Australia's south east.

An El Niño event will increase the chances of record-high temperatures and extreme weather patterns over the next 12 months, particularly in eastern Australia.

The impact of El Niño typically leads to more severe heatwaves, heightened bushfire risks, and worsening drought conditions as last experienced in the lead up to the catastrophic 2019-20 Black Summer bushfires.

The total insurance damage from this catastrophic event totalled $2.32 billion with close to 39,000 claims lodged.

Since the 2019–20 Black Summer bushfires, insurers have paid out more than $16.8 billion in natural disaster claims from 13 declared catastrophes and five significant events.

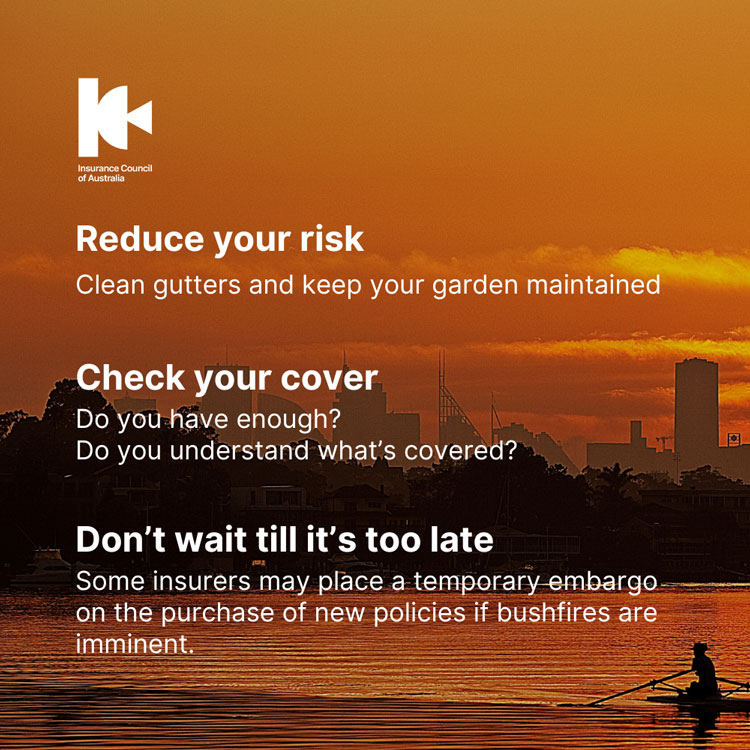

There are preparatory steps that property owners and tenants can take now to reduce the impact of potential bushfires on their property, finances, and wellbeing:

- Inspect your property and take practical steps to reduce risk such as cleaning your gutters, keeping lawns and gardens maintained and cleaning up green waste items around the property.

- Use a building and contents insurance calculator to ensure your insurance cover adequately covers estimated costs to repair, rebuild or replace home and contents, vehicles and any outbuildings on your property in event of a disaster.

- Prepare a room-by-room inventory of the contents of your home. This list helps determine if your assets are adequately protected and can save time when making a claim.

- Review all building, contents, and landlord insurance policies. Make sure you understand what cover you have, as well as any exclusions or limits that may be a part of your insurance policy. It is important to be aware of these exclusions and to query your insurer about any part of a policy you do not understand.

- Ensure you are covered now before bushfire threats are heightened, as some insurers may place a temporary embargo on the purchase of new policies if bushfires are imminent.

Further information on what to do before, during, and after a bushfire event can be found on the Insurance Council of Australia's website.

Quotes attributable to Insurance Council of Australia Acting CEO Kylie Macfarlane:

Now is not the time to be complacent when it comes to bushfire preparedness, with El Niño already showing signs of a hot and dry summer.

The Insurance Council of Australia is urging all property owners, especially those in high-risk areas, to ensure they have adequate insurance to cover the cost of any potential disaster.

While not all insurers enact coverage embargoes during bushfires or when an area is at risk, property owners must not gamble on their insurance protection.

We want communities to be better prepared, particularly those that remain vulnerable and are still recovering from the damage and destruction of past catastrophic events.