Home Types of insurance

Insurance Significant Event declared for Tropical Cyclone Jasper

News release

Monday, 18 December 2023

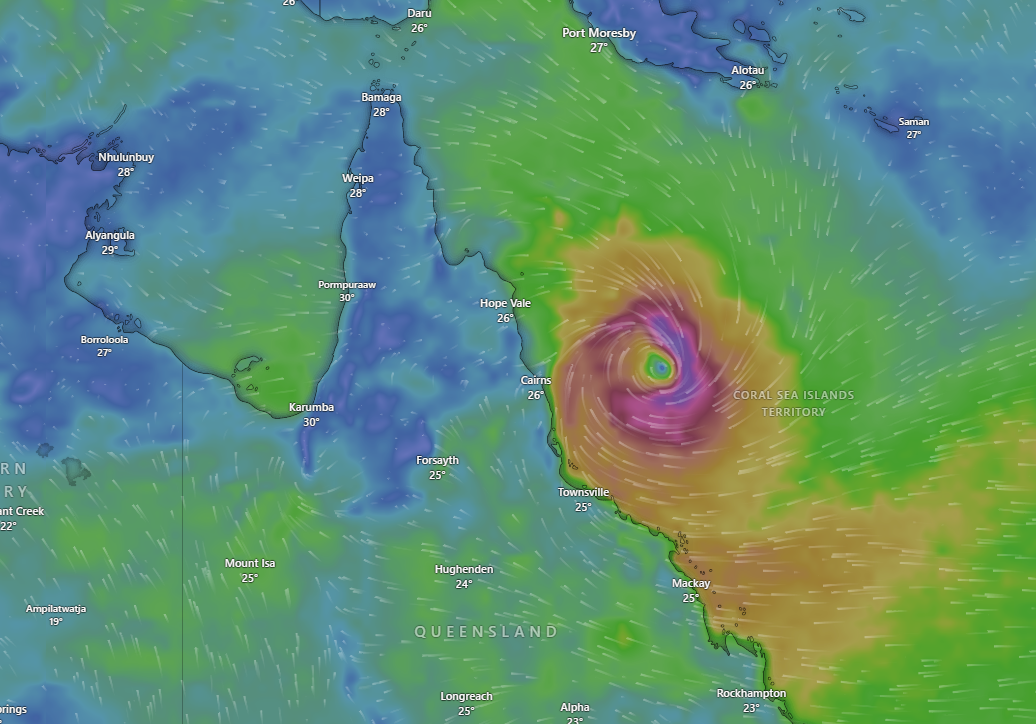

The Insurance Council of Australia (ICA) has declared a ‘significant event’ for regions of Far North Queensland impacted by severe weather and flooding over the past week, following Tropical Cyclone Jasper.

The ICA's preliminary extreme weather processes have been activated, assisting the ICA and insurers to assess the insurance impact of the current flood event.

Under a significant event declaration:

- The ICA commences its claims data collection, analysis, and reporting processes in consultation with members.

- ICA representatives will continue to work with government and agencies to understand impacts on the community and ensure affected residents receive assistance.

While it’s too early to determine the complete insurance impact on homes and businesses due to the ongoing emergency, this event may be escalated to an insurance catastrophe if there is a significant increase in claim numbers or complexity, if the geographical spread of this event is extended or in consultation with insurers.

The ICA is working with government and agencies to understand impacts on the community and ensure affected residents receive assistance. The impact of flooding has been felt most significantly in communities between Innisfail and Hope Vale, however all regions impacted by flood following Tropical Cyclone Jasper fall under the significant event declaration.

The ICA and member insurers are already taking action to assist customers, with plans to deploy teams to community centres in impacted regions as soon as waters subside, access to land and air transport is restored, and impacted areas are declared safe by emergency services. This will provide impacted customers an opportunity to speak in person with their insurer as they begin their claims process.

This remains an unfolding weather event and insurers’ priority is community safety. We strongly encourage all those impacted to put their safety first and adhere to evacuations orders.

Comment attributable to Kylie Macfarlane, COO, Insurance Council of Australia:

The insurance industry is committed to supporting customers impacted by flooding and storm damage following Tropical Cyclone Jasper. This significant event declaration activates additional services and resources to ensure timely and efficient assistance.

If your property has been impacted, please contact your insurer as soon as possible to commence the claims process, even if you do not know the full extent of damage.

Insurers understand this is a distressing time for policyholders in the lead up to Christmas and will be placing a high priority on claims lodged following this event.