Home Severe Weather Page 2

Ex-Tropical Cyclone Alfred insurance update

News release

Monday, 10 March 2025

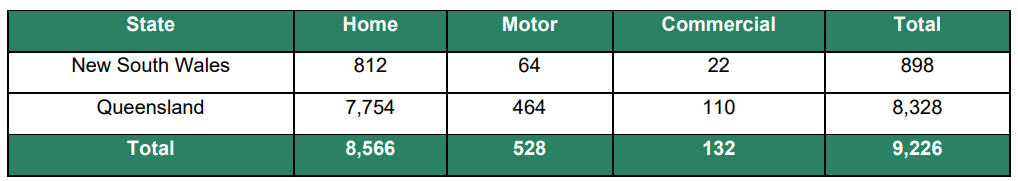

Policyholders have lodged more than 9,000 insurance claims associated with the ex-TC Alfred in south-east Queensland and New South Wales as of midday today, the Insurance Council of Australia (ICA) reported today.

The vast majority of claims so far have been from Queensland.

It is too early to estimate the cost of the damage, however based on previous similar events insurers expect many more thousands of claims to be made in coming days and weeks.

Yesterday the ICA declared an Insurance Catastrophe for the southeast Queensland and northern New South Wales regions impacted by this event since Friday 28 February.

The impact of the ex-TC Alfred has been felt most significantly in the Gold Coast, Brisbane, Hervey Bay, and the Northern Rivers, however the declaration covers all claims related to the event since Friday 28 February.

The ICA’s Catastrophe declaration serves to escalate and prioritise the insurance industry’s response for affected policyholders. Under the Catastrophe declaration:

- Claims from affected policyholders will be given priority by insurers.

- Claims will be triaged to direct urgent assistance to the worst-impacted property owners.

- ICA representatives are mobilised to work with local agencies and services and affected policyholders as soon as emergency services say it is safe to do so.

- Insurers mobilise disaster response specialists to assist affected customers with claims and assessments as soon as emergency services say it is safe to do so.

- An industry taskforce is established to identify and address issues arising from this catastrophe.

Information about clean up and the claims process can be found on the ICA’s website: www.insurancecouncil.com.au/DisasterHelp

Quote attributable to Andrew Hall, CEO, Insurance Council of Australia:

This remains an active event and it will take some time to gain a clearer picture of the damage.

Insurers expect a large number of claims will be lodged in coming days as property owners begin returning to homes and businesses.

We encourage policy holders to contact their insurer as soon as practically possible even if they have not been able to return to their home.

Frequently Asked Questions

Lines below can be used by media and attributed to a spokesperson from the ICA:

What should impacted residents do in the aftermath of this event?

Due to the strong winds associated with TC Alfred, be mindful of electrical hazards and fallen powerlines. Never approach or attempt to move fallen wires, even if they appear inactive.

What to do in the immediate aftermath:

- Safety is the priority - don’t do anything that puts anyone at risk.

- If water has entered the property, don't turn on your electricity until it has been inspected by an electrician.

- Contact your insurance company as soon as possible to lodge a claim and seek guidance on the claims process.

- Property owners who have sustained roof damage should advise their insurer.

- Do not drive your vehicle if it has suffered water damage.

How should policyholders approach the clean-up process?

If you've been given the go-ahead to return to your property, you can clean up if it's safe to do so, but check out these tips first.

- Remain mindful of safety

- Before you start your cleanup, document the damage with photos and videos to support an insurance claim.

- Take photos before removing any water damaged or soaked items that may pose a health risk.

- Make a list of damaged items, including the brand, model and serial number if you can.

- Don't throw away items that could be repaired unless they pose a health risk.

- Speak to your insurer before you attempt or authorise any building work, including emergency repairs, and ask for the insurer’s permission in writing, as unauthorised work may not be covered by your policy.

How much will the total damage bill for TC Alfred amount to?

It is currently too early to tell the impact that TC Alfred will have and what the total damage bill will be.

The last cyclone to hit Australia, Tropical Cyclone Jasper (2023), cost $409 million from around 10,500 claims.

The costliest cyclone to hit Australia remains Cyclone Tracy (1974), which normalised to 2023 values would incur $7.4 billion in claims.

The floods of early 2022 remain the costliest insured event in Australia’s history with $6.4 billion in insured losses across more than 245,000 claims.

Is cyclone damage typically covered under standard home and contents policies?

Most standard home and contents policies in Australia will cover damage caused by cyclones but this is something customers should clarify with their own insurer or by reading their product disclosure statement. However, some customers may have opted out of flood cover. Customers are encouraged to contact their insurer if they want to better understand what they are covered for.

How many homes/businesses are at risk of flood?

Floods pose a critical threat to Australia. Around 1.36 million properties across the country face some risk of flooding, and it is estimated that half of these properties fall short of the flood resilience measures of modern planning and building standards. Around 298,000 of these properties – approximately 225,000 homes and 73,000 businesses – face at least a two or five per cent chance of flooding each year. 91,000 of these are in Queensland.

There is a clear correlation between high flood exposure and low socioeconomic status. Analysis of the 2024 National Flood Information Database (NFID) indicates that approximately 70 per cent of households exposed to the highest flood risk are in areas where the median income is below the national median ($92,000), and around 35 per cent of these households are in areas where the median income is below the poverty line ($58,000).

Of the estimated 225,000 homes in the highest flood risk locations across the country, only around 23 per cent have flood cover, compared to an estimated 60 per cent nationwide.

In February 2025, the Insurance Council released its Federal Election Platform which included a call for a Flood Defence Fund at a cost of $30.15 billion over ten years, shared by the Federal Government and the state governments of Queensland, New South Wales and Victoria, which would:

- Deliver new critical flood defence infrastructure ($15 billion)

- Strengthen properties in harm's way ($5 billion)

- Managed relocation (buy-backs) ($10 billion)

- Future-proof existing flood mitigation infrastructure ($150 million)

Will insurance premiums increase as a result of TC Alfred?

Giving the changing nature of this weather event, it is too early to predict what impact it will have on premiums.

However, the frequency and severity of natural disasters has increased in recent years and this is contributing to higher premiums. Insurers have been calling on governments to invest more in resilience and mitigation to protect the many Australians who are living in harm’s way and improve insurance affordability and availability – as outlined by our call for a Flood Defence Fund in our Federal Election Platform released in February.

What does it mean when the ICA officially declares an Insurance Catastrophe (CAT)?

The ICA’s catastrophe declaration serves to escalate and prioritise the insurance industry’s response for affected policyholders. This will activate special services and support for homeowners and businesses within the official declaration zone.

Under the Catastrophe declaration:

- Claims from affected policyholders will be given priority by insurers.

- Claims will be triaged to direct urgent assistance to the worst-affected property owners.

- ICA representatives will be mobilised to work with local agencies and services and affected policyholders as soon as emergency services say it is safe to do so.

- Insurers will mobilise disaster response specialists to assist affected customers with claims and assessments as soon as emergency services say it is safe to.

- An industry taskforce has been established to identify and address issues arising from this catastrophe.