Home Disaster & catastrophes Page 16

East Coast flood event insurance update – 3 March

News release

Thursday, 3 March 2022

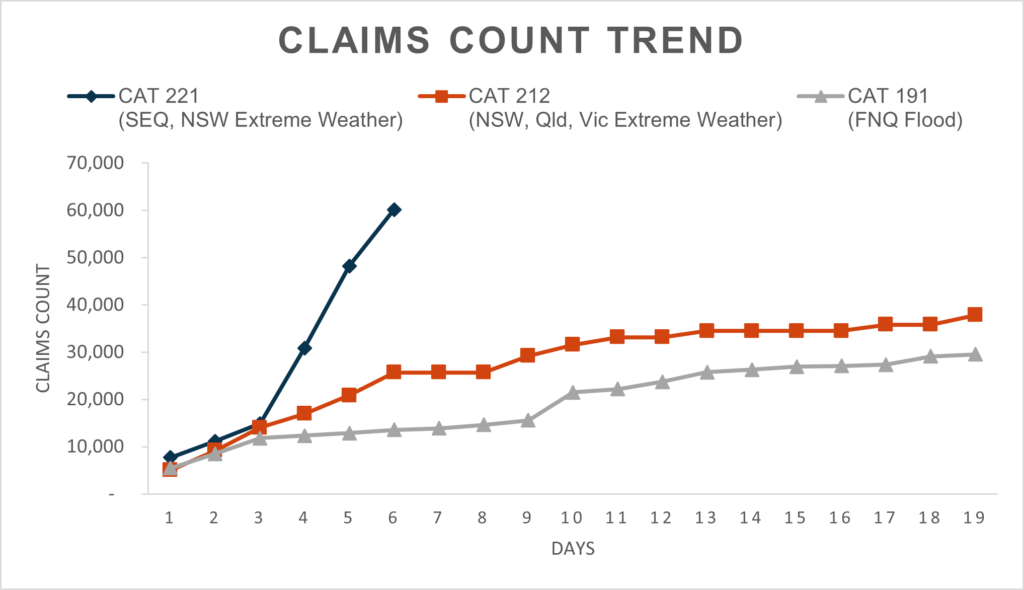

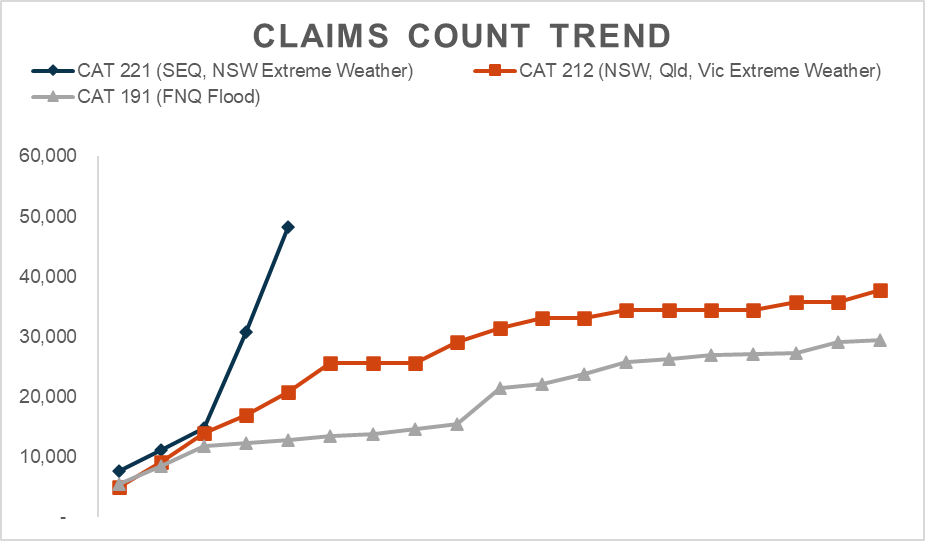

The Insurance Council of Australia (ICA) today said insurers have received 60,163 claims related to the ongoing flooding in South-East Queensland and New South Wales.

This is a 25 per cent increase on yesterday’s claims count. (See graph)

46,235 of these claims are from Queensland and 13,928 are from New South Wales. New South Wales figures are expected to increase in coming days given the current flood emergency impacting in and around Sydney.

Eighty-three per cent of total claims relate to property, with the remainder motor vehicle.

Based on previous flood events the current cost of claims is estimated to be approximately $900 million. This figure is subject to detailed assessment of claims as loss adjustors move in over the coming weeks and will increase as further claims are made.

(Please note: this is an estimate of the current claims cost – other figures provided to the media are estimates of the ultimate cost.)

Although this event is still very much unfolding in and around Sydney and there are concerns about further storm activity in and around Brisbane, insurers are already working with Local, State and Federal Governments and their agencies to support customers through the recovery process.

The ICA has raised with government stakeholders concerns about the impact of labour constraints and materials shortages on the rebuild and recovery process.

The current flooding comes off the back of a period of consistently high claims because of ongoing summer storm activity, and impacts from the pandemic on labour and materials availability and building costs.

Quote attributable to Andrew Hall, CEO, Insurance Council of Australia:

This is an ongoing and severe weather event, so it is still too early to predict where it will end.

These severe weather systems have been impacting the East Coast now for more than a week and are still very active across all regions.

Despite that, insurers are working closely with Local, State and Federal Governments to ensure that insurers are fully coordinated in the recovery process that is starting to commence in communities up and down the coast.

I urge all impacted policyholders to contact their insurer via phone or online as soon as possible, so we can ensure all available help and assistance can be provided, including short-term accommodation or help with food and essentials.

Remember

- Safety is the priority – don’t do anything that puts anyone at risk

- Only return to your property when emergency services give the go ahead

- If water has entered the property, don't turn on your electricity until it has been inspected by an electrician

- Contact your insurance company as soon as possible to lodge a claim and seek guidance on the claims process

- Property owners who have sustained roof damage should advise their insurer, your insurer will arrange emergency works to minimise any hazards and prevent further damage. This can include isolating damaged solar panels or electrical circuits and installing a roof tarp

- Don’t worry if you can’t find your insurance papers – insurers have electronic records and need only your name and address

What to do if your property has been impacted by flooding and storms

- You can start cleaning up but first take pictures or videos of damage to the property and possessions as evidence for your claim

- Keep samples of materials and fabrics to show your insurance assessor

- Remove water damaged goods from your property that might pose a health risk, such as saturated carpets and soft furnishings

- Make a list of each item damaged and include a detailed description, such as brand, model, and serial number if possible

- If water has entered the property, do not turn on your electricity until it has been inspected by an electrician

- Store damaged or destroyed items somewhere safe where they do not pose a health risk

- Speak to your insurer before you attempt or authorise any building work, including emergency repairs, and ask for the insurer’s permission in writing. Unauthorised work may not be covered by your policy

- Do not throw away goods that could be salvaged or repaired