Home Disaster & catastrophes

Insurer townhall and consultations scheduled for Hervey Bay

News release

Thursday, 1 May 2025

The Insurance Council of Australia (ICA) is hosting an insurer townhall and consultations in Hervey Bay this month for customers affected by ex-Tropical Cyclone Alfred.

Impacted policyholders will have the opportunity to meet one-on-one with representatives from a number of insurers, giving them an opportunity to discuss their individual claim and seek personal advice.

In the evening, the ICA will host a townhall where locals will also have the opportunity to obtain general information on the claims process, complaints avenues and other useful insurance-related information to assist with insurance claims and the recovery process.

Details of the townhall and consultations are as follows:

Date: Thursday 15 May 2025

Location: The Clubhouse Hervey Bay, Corner Tooth St & Old Maryborough Road, Pialba, Hervey Bay

Time: One-on-one insurer consultations - 10:00am to 4:00pm.

Townhall - 5:00pm, with further consultations to follow until 8:00pm.

Registrations for the consultations and the townhall are essential. Bookings can be made on the ICA website at www.insurancecouncil.com.au/bookings.

Quote attributable to ICA Director of Mitigation and Extreme Weather Response, Liam Walter:

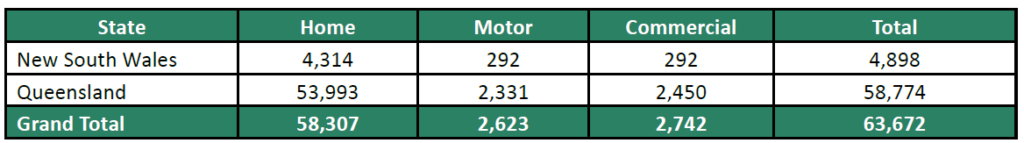

The impacts of ex-Tropical Cyclone Alfred are still being felt in many communities, with more than 100,000 claims received totalling almost $1 billion.

While the Insurance Council and its members had presence in Hervey Bay immediately following this weather event and provided support and advice for impacted community members, it’s important for insurers to visit the region to work through any questions, issues or concerns.

We expect assessments activities and scope of works discussions are well underway at this point in the claim process but hope these additional forums will provide further support for the Hervey Bay community as they continue their recovery.