Home Cyclone & storm Page 9

Prepare now for La Niña

News release

Saturday, 17 September 2022

The Insurance Council of Australia (ICA) says now is the time to prepare property for what is forecast to be a wet spring and possibly summer across eastern Australia, following the declaration of a La Niña weather pattern by the Bureau of Meteorology.

The predicted La Niña would be the third in a row for eastern Australia.

In 2021 and 2022 La Niña rain patterns led to destructive floods across many communities in parts of south-east Queensland and New South Wales.

For communities with sodden soils, full catchments and flood damaged homes not yet repaired this is unwelcome news.

The 2021 and 2022 combined insurance damage bill for La Niña-generated east coast storm and flooding is at $5.92 B with more than 296,000 claims lodged.

However, there are preparatory steps that property owners can take now, particularly in areas with a history of flooding, to reduce the potential impact of the forecast heavy rain and possible flood on property, finances and wellbeing.

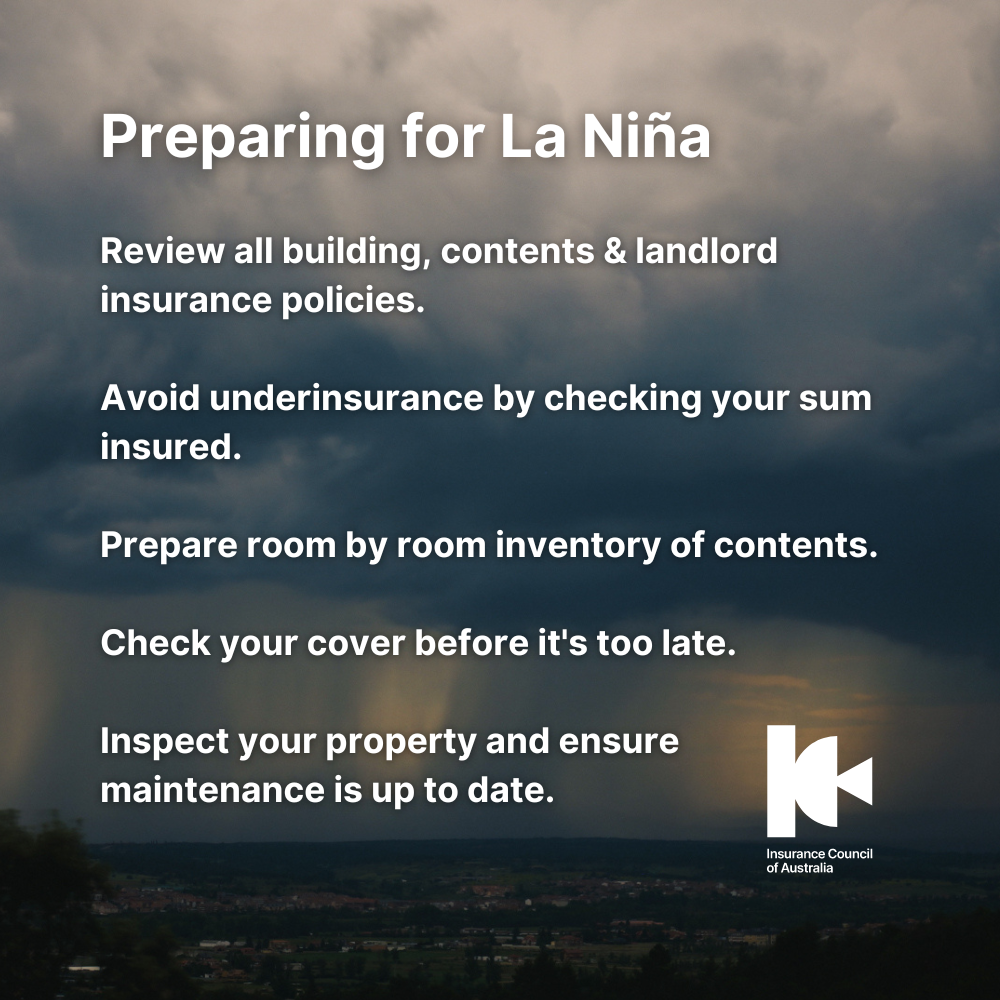

The Insurance Council’s top five prep steps are:

- Review all building, contents, and landlord insurance policies, checking cover for flood and storm. Check cover for temporary accommodation for people and pets.

- Review your building and contents sum insured, checking that the insurance sum matches current replacement, repair and rebuild costs for your home and contents. Using a building and contents insurance calculator to check the current value helps avoid the shock of finding out you are underinsured after an event.

- Prepare a room-by-room inventory of the contents of your home. This list helps determine if you have enough insurance and can save time when making a claim.

- Ensure you are covered now before the forecast La Niña rain starts to fall, as some insurers may place a temporary embargo on the purchase of new policies if storm and flooding is imminent.

- Inspect your property and take practical steps such as clearing gutters and downpipes to help water escape to reduce the risk of overflow and damage to walls and ceilings. Ensure your roof, windows and doors can withstand heavy rainfall.

Quote attributable to ICA CEO Andrew Hall:

The last couple of years have shown the impact that heavy rains can have on property, livelihoods, and our own well-being.

We can’t control the weather, but there are practical steps we can all take to reduce the risk that storm and flood can bring or make recovery from those events easier.

Following our top five prep steps will mean you are better prepared for the heavy rainfalls that have been predicted by the Bureau of Meteorology.