Home Cyclone & storm Page 3

Don't get caught short. Be summer ready.

News release

Monday 14 October 2024

With summer fast approaching, the Insurance Council of Australia (ICA) is urging homeowners and tenants to prepare for the upcoming storm and bushfire season.

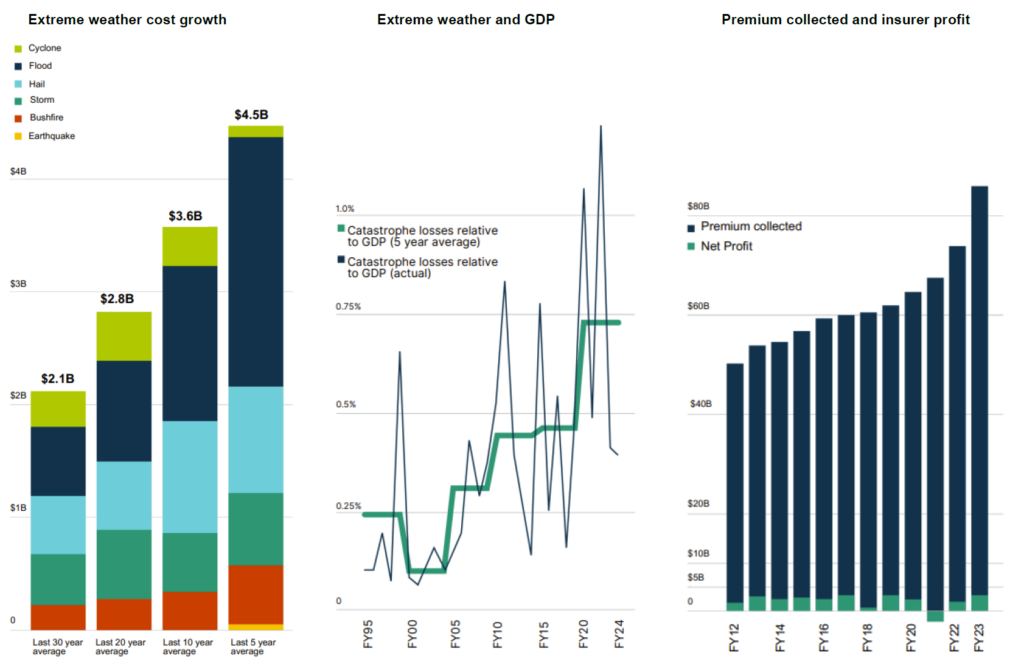

Extreme weather can strike at any time, however insurers see a greater number of events between October and April. Since 2013, 78 per cent of all declared insurance catastrophes have taken place between October and April and 90 per cent of catastrophe-related losses have been incurred in those months.

The Bureau of Meterology is already predicting increased risk this summer, with higher fire risk predicted for parts of Vicrtoria South Australia because of the lower than average rainfall through winter, greater risk of storm and flash flooding across large parts of Australia's east coast, and above average risk of severe cyclones in the north because of warmer sea temperatures.

Before extreme weather season arrives, there are practical actions that all householders can take to prepare for and reduce the risk of extreme weather. These include:

- Inspect your property and take practical steps to reduce risk such as cleaning gutters, keeping lawns and gardens maintained and cleaning up green waste items around the property. Take the advice of relevant agencies in your area when preparing your home for summer weather conditions.

- Prepare a room-by-room inventory of the contents of your home. This list helps determine if your assets are adequately protected and can save time when making a claim.

- Use an online building and contents calculator to ensure your insurance cover adequately covers estimated costs to repair, rebuild or replace home and contents, vehicles and any outbuildings on your property in event of a disaster.

- Review all building, contents, and landlord insurance policies. Make sure you understand what cover you have, as well as any exclusions or limits that may be part of your insurance policy. It is important to be aware of these exclusions and to query your insurer about any part of a policy you do not understand.

- Ensure you are covered now before extreme weather threats are heightened, as some insurers may place a temporary embargo on the purchase of new policies if extreme weather is imminent.

Quotes attributable to ICA CEO Andrew Hall:

We’ve already seen an early start to storm season, with flooding in parts of Victoria and Tasmania last month and storms in south-east Queensland last week.

Storm season is unpredictable and in Australia extreme weather can strike any place and at any time. That’s why it’s vital to be prepared and ensure your insurance cover is up-to-date.

The costs of home repairs and rebuilding hs risen by 27 per cent since 2020, making it vital that property owners know that their sum insured is adequate.

We also recommend consulting your local state emergency service for safety tips, and to keep informed via resources available from fire and emergency services agencies.