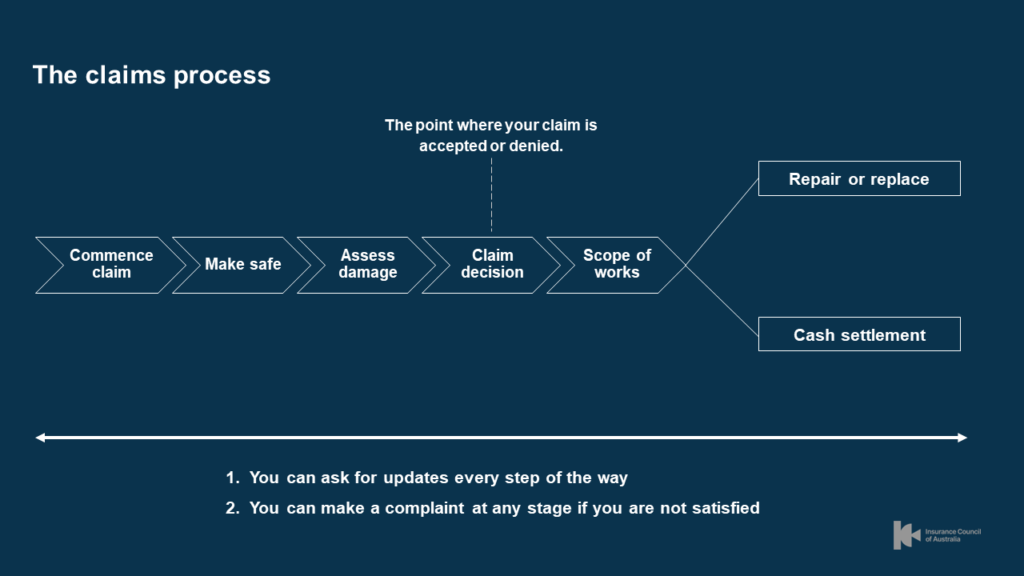

Commence claim

First step is contacting your insurer and you can do this, even if you don’t know the full-extent of damage.

Make safe

If your property has been damaged, your insurer will arrange emergency works as soon as it is safe to do so to minimise any hazards and prevent further damage. This can include removing loose debris, isolating damaged solar panels or electrical circuits and installing a roof tarp.

Assessing the damage

An insurance assessor (or claims adjuster) will inspect the damage to your property. Specialist reports may be required to determine aspects of your claim, for example Hydrologists may be required to determine the cause of water inundation and Engineers may be required to consider any structural damage.

Claim decision

This is a key claim milestone where your Insurer will confirm what you are covered for. The nature of a claim will determine how long it takes to make a claim decision, for example where specialist reports are required the decision process will generally take longer

Scope of Work (or Statement of Work)

The Scope of Work is the written report that sets out the repair or rebuild work to be performed and end products that are expected to be used. It’s important to read the report and let your insurer know if changes are required. The initial scope of works may need to be reassessed after repairs have started or if further damage is uncovered – and that is ok, revision of the scope of works is a normal part of the process.

Repair / replace or cash settlement

Repair or replace

Once your Scope of Work has been agreed, it’s time to repair or replace the damaged property. If your insurer is managing the repair/rebuild, they will appoint a builder, arrange the contracts and notify you of the construction schedule. Your insurer will also manage local council approvals as required.

Cash settlement

Alternatively, you may take a cash settlement to manage the repair or rebuilding work yourself. It’s important that you comply with council regulations and buildings codes, as well as using a licensed builder. If you fail to do this, your home may not be insurable in the future.

Feedback / complaints

If you are unhappy with the handling of your insurance claim, you can lodge a complaint with your insurer. Your insurer has a dedicated dispute resolution process to resolve your concerns. And as AFCA will highlight, if you need further assistance, you can contact the Australian Financial Complaints Authority.