Monday, 13 February 2023

Home insurance customers in NSW will see a reduction of around 15 per cent in their annual premium costs if the next State Government removes the Emergency Services Levy (ESL) and finds a fairer way to fund emergency services, a new report from the Insurance Council of Australia (ICA) finds today.

Released in the lead up to next month’s state election, A Stronger NSW finds that because of the ESL NSW insurance customers are paying nearly three times the amount of state taxes than Victorian insurance customers.

This is contributing to an estimated 13 per cent of NSW households being uninsured – double the rate in Victoria.

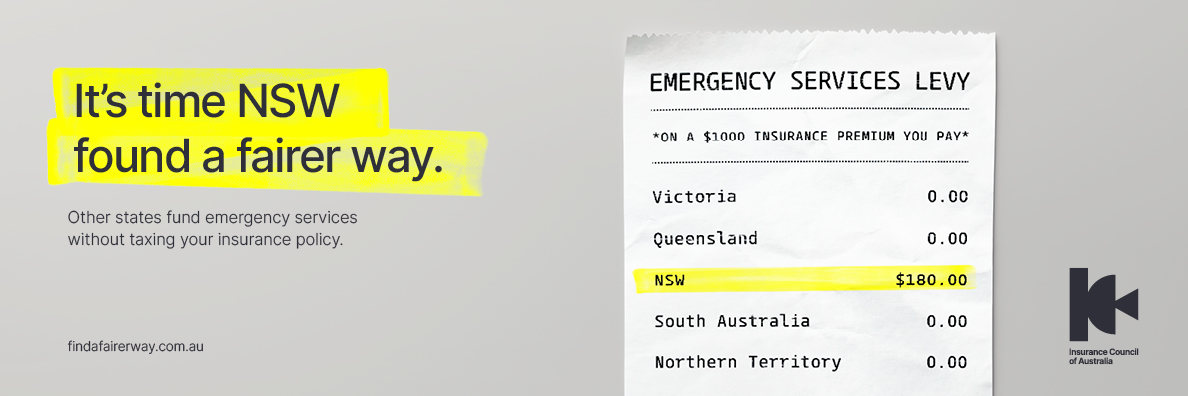

NSW is the only mainland state that still funds emergency services by applying a levy on insurance, which is currently adding around 18 per cent to home insurance premiums and up to 40 per cent to business cover.

To support its call for reform of the ESL, a state-wide advertising campaign commences today calling on the next NSW Government to “find a fairer way” to fund emergency services and bring NSW in line with every other mainland state and territory.

This campaign is backed by new research conducted for the Insurance Council which shows that almost two-thirds of NSW voters (65%) support removing the ESL and replacing it with an alternative funding model for emergency services.

In addition to reform of the ESL, A Stronger NSW outlines eight other policy recommendations for the next NSW Government to reduce risk and put downward pressure on the cost of insurance in the State:

- Prevent the development of new homes in high-risk areas by reviewing land use planning arrangements based on water catchments

- Protect homes and communities by investing in measures such as community infrastructure, improved flood early warning systems and home retrofit programs

- Design and construct stronger homes by including the principle of resilience in building standards

- Reform written-off vehicle rules for sustainable car insurance and to promote supply of second-hand vehicles

- Accelerate the transition to electric vehicles by ensuring homes are EV ready and addressing skills shortage in EV repair

- Review current tort law and civil liability settings to increase insurance affordability and availability for small businesses

- Remove unfair insurance requirements from government contracts

- Enable households, communities, government, and agencies to better prepare, protect and respond to disasters through improved and consistent data standards

In 2022 NSW suffered $3.3 billion in insured losses from 150,100 claims relating to extreme weather events, the majority of which came as a result of the February-March floods which cost almost $2.9 billion in insured damages across the State.

Quote attributable to ICA CEO Andrew Hall:

The policy recommendations outlined by the Insurance Council today in our A Stronger NSW report will drive action on reducing risk and addressing the critical issue of insurance affordability and availability in NSW.

The abolition of the emergency services levy is key to this: the next NSW Government must find a fairer way to fund emergency services without having the burden fall directly on insurance policy holders.

At a time when adequate insurance cover is more important than ever, home insurance customers in NSW are paying the most tax in Australia and this is leading to lower levels of insurance when compared to other states.

The NSW emergency services levy weakens our collective capacity to recover from natural disasters and increases the burden on NSW taxpayers for financial relief.

We encourage whoever wins the NSW election in 40 days’ time to urgently take up this and the other eight policy proposals to reduce risk and improve insurance outcomes in the State.

For further information go to: www.findafairerway.com.au