Wednesday, 12 March 2025

The Insurance Council of Australia (ICA), insurers, reinsurers, the National Emergency Management Agency and other government agencies met this morning to discuss how the insurance sector is supporting customers impacted by ex-TC Alfred.

The meeting heard that insurers pre-emptively contacted more than a quarter of a million customers across south-east Queensland and northern New South Wales with safety and preparedness tips and how to lodge a claim as quickly as possible.

Insurers added hundreds of additional claims consultants, engaged round-the-clock major event response teams during the active phase of the event, pre-reserved temporary accommodation for impacted customers, and secured a strong network of builder and supplier capacity in potentially impacted areas.

While claims types differ from region to region, insurers reported that pre-event concerns about large numbers of severe wind damage claims have not been realised, with some customers in localised areas making flood claims and many more thousands of customers across the path of the event making claims related to storm-driven water damage and food spoilage due to power outages.

Insurers having already paid almost $2.4 million in emergency cash payments to almost 6,000 impacted policyholders, generally for items such as food spoilage and temporary accommodation.

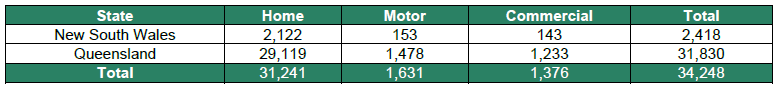

As of midday today, insurers have received more than 34,000 claims across southeast Queensland and northern New South Wales, an increase of more than 50 per cent since yesterday.

The ICA also warned today about ‘disaster chasers’ operating in impacted communities. Disaster chasers may offer to undertake work such as tree and debris removal, requesting payment upfront in cash but often leaving work poorly done or incomplete.

Disaster chasers can also offer to undertake home inspections or repairs for cash payment. Some disaster chasers pressure homeowners to sign a contract on the spot for future repair work and may promise their insurer will pay.

This can leave the homeowner liable to pay a commission or inflated repair bills not covered by their insurance policy, as insurers will only pay for approved work that is covered by a policy.

Residents who believe they may have been approached by or signed with a disaster chaser should seek guidance from their insurer.

Quote attributable to Andrew Hall, CEO, Insurance Council of Australia:

As part of the recovery from ex-Tropical Cyclone Alfred insurers and reinsurers met today with NEMA and other government agencies to share what the industry is observing on the ground.

This ongoing dialogue with our partners in government is crucial to ensuring that resources are deployed to where they are needed most.

Insurers have already paid out almost $2.4 million in 6,000 small emergency cash payments to help impacted customers get through the immediate aftermath of this event, for items such as food and temporary accommodation.

Claims numbers are increasing significantly each day, with more than 34,000 claims now received by insurers, the large majority from Queensland.