Home Media releases Page 33

ICA Opening statement Senate Economics Legislation committee hearing into the Northern Australia Cyclone Reinsurance scheme

News release

Tuesday, 8 March 2022

Thank you Chair. My name is Mathew Jones, and I am the General Manger for Public Affairs at the Insurance Council, and I'm supported today by our General Manager for Policy – Regulatory Affairs, Aparna Reddy, who led the Insurance Council’s response to the Cyclone Reinsurance Pool Bill currently before you.

ICA CEO Andrew Hall is travelling to Lismore today to engage with local MPs, stakeholders and the community, and unfortunately and at short notice, travel delays mean he is unable to be here today.

By way of introduction, general insurers provide Australians with 43 million business and household policies each year and pay more than $166 million in claims every working day.

Insurance is a key component of the economy, especially in a country like Australia, where events of the last two weeks have once again reminded us of the challenges we face in protecting our assets.

Not counting this current event, since the Black Summer of 2019-20 there have been more than 560,000 losses reported from ten declared insurance catastrophes resulting in more than $8.7 billion in claims.

In the calendar year 2020 insurers made a combined profit of only $35 million. While conditions have improved somewhat since then, those areas of Australia most exposed to the risk of extreme weather remain challenging for insurers.

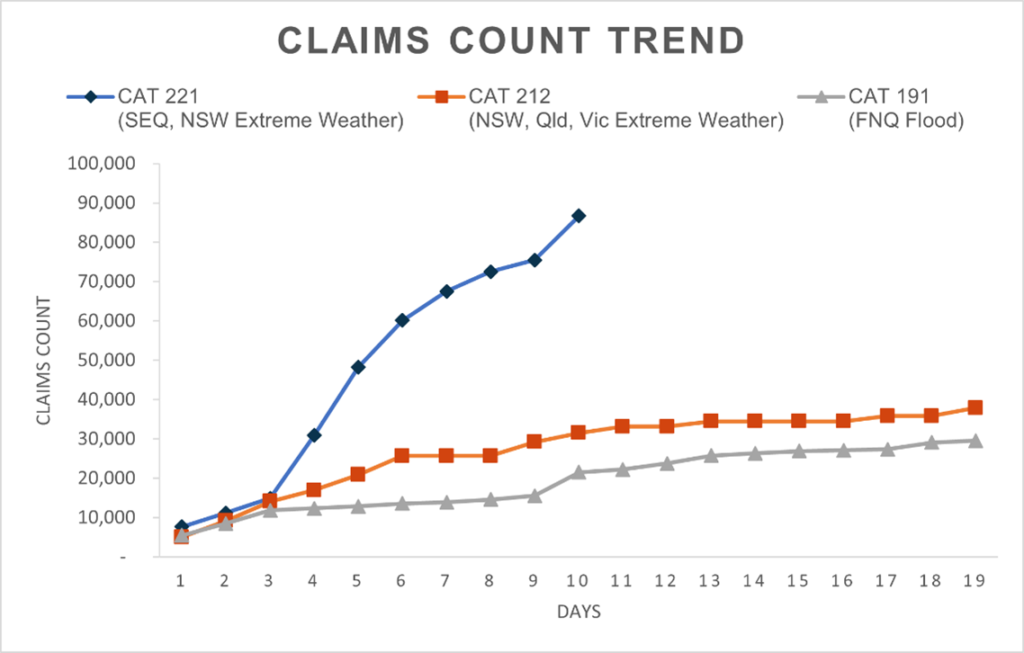

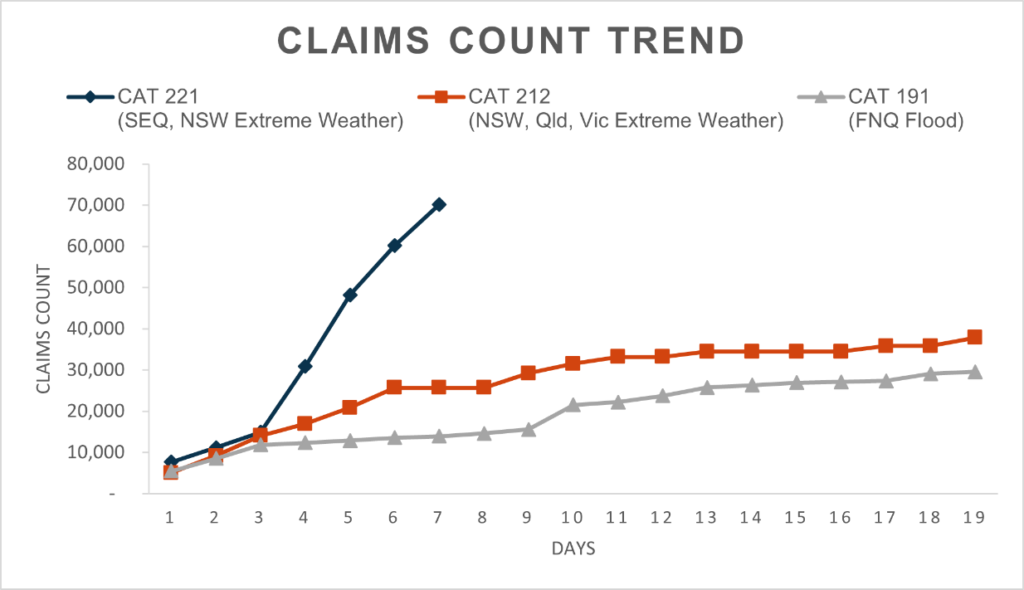

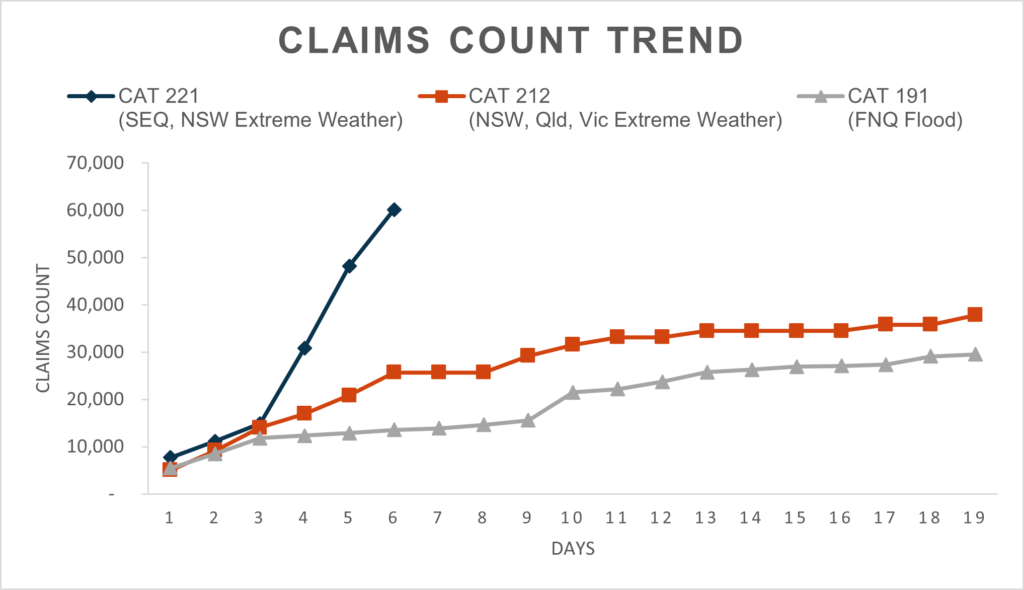

Over the past two weeks insurers have received almost 100,000 claims related to the floods in South East Queensland and New South Wales, and so far this is estimated to cost insurers $1.45 billion.

Extreme weather risk in this country is getting worse, but there are actions we can take that can lessen the impact. I trust that the images we have seen in the last few days from Lismore and other devastated communities have made plain that governments must invest more in programs that make homes more resilient and protect communities through infrastructure like levees and floodways.

Governments at all levels must also improve resilience standards in building codes, remove state insurance stamp duties and levies, and make better land planning decisions that factor in worsening extreme weather and its impacts.

The 2020 Northern Australia Insurance Inquiry undertaken by the Australian Competition and Consumer Commission didn’t raise any issue with insurers’ pricing practices. Instead, it found that the main driver of premiums in northern Australia was a higher risk of extreme weather from cyclone and cyclone-related flood.

The same inquiry found that over the 12 years from FY 2007-08 insurers in northern Australia suffered combined losses in the region of $856 million, highlighting the pressure insurers are under to deliver for customers in a way that is financially sustainable.

Reducing the cost of reinsurance is only one part of improving the affordability and availability of insurance for those living with the threat of cyclones in northern Australia.

Sustainable reductions in premiums over the long term and better protection for at-risk communities will only be possible with significant investments to make communities more resilient to extreme weather risk, including cyclone and related flood.

The Productivity Commission has recommended Commonwealth investment in this area should be $200 million a year, which is around double what is currently allocated, matched by the states and territories.

Because well-designed resilience programs can work to provide much needed relief to households. For example, the Queensland Household Resilience program resulted in an average insurance premium reduction of 7.5 per cent, with some reductions of up to 25 per cent.

We stand ready to provide data to Government on where investment in resilience and mitigation will provide the maximum benefit and put downward pressure on premiums.

Insurers strongly support the Government’s commitment to reviewing the Pool’s effectiveness.

We expect insurers will take advantage of the Pool to provide additional cover for households and small businesses in northern Australia most at risk. The next step of commercial negotiations with the ARPC will need to be completed to fully understand the impact on premiums.

As part of the establishment of the Pool, the ACCC has been tasked with price monitoring. Insurers welcome the ACCC’s ongoing price monitoring role, given their expertise and understanding of this issue. However, the Government must ensure this process doesn’t add complexity or costs into the system.

We're happy to take any questions from the Committee.